What To Watch This Week For Bitcoin

BTC Holds Within Range

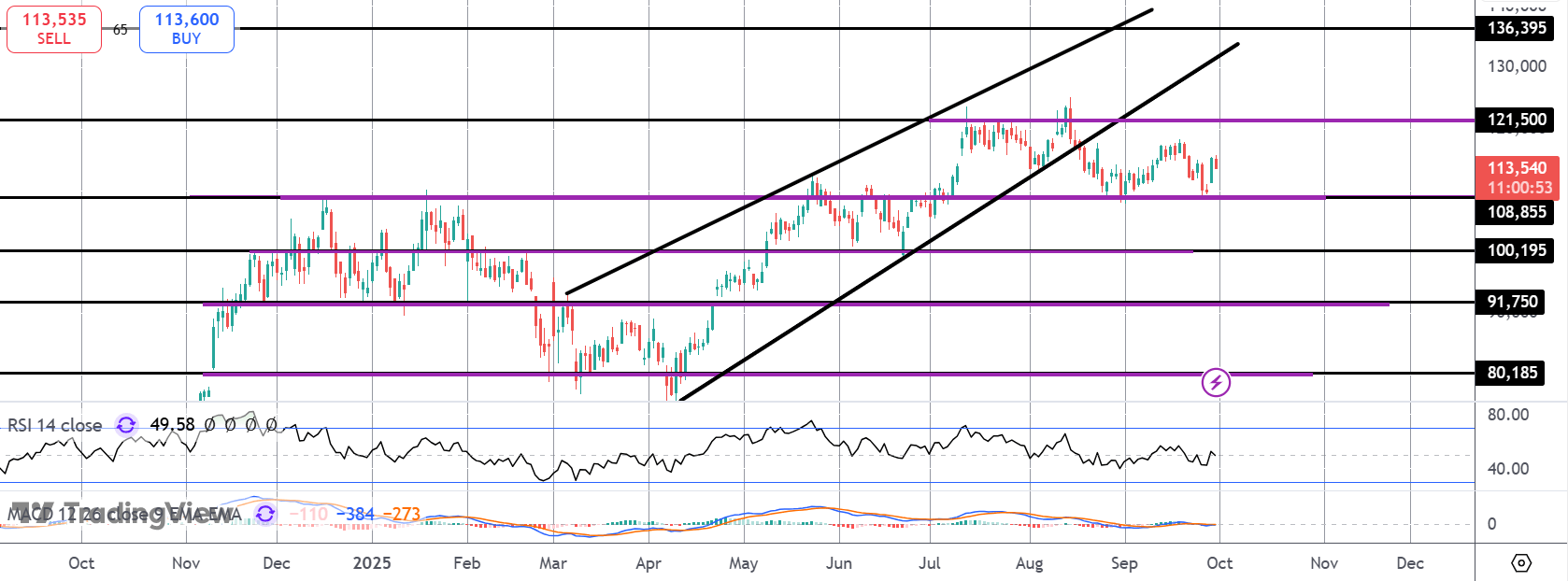

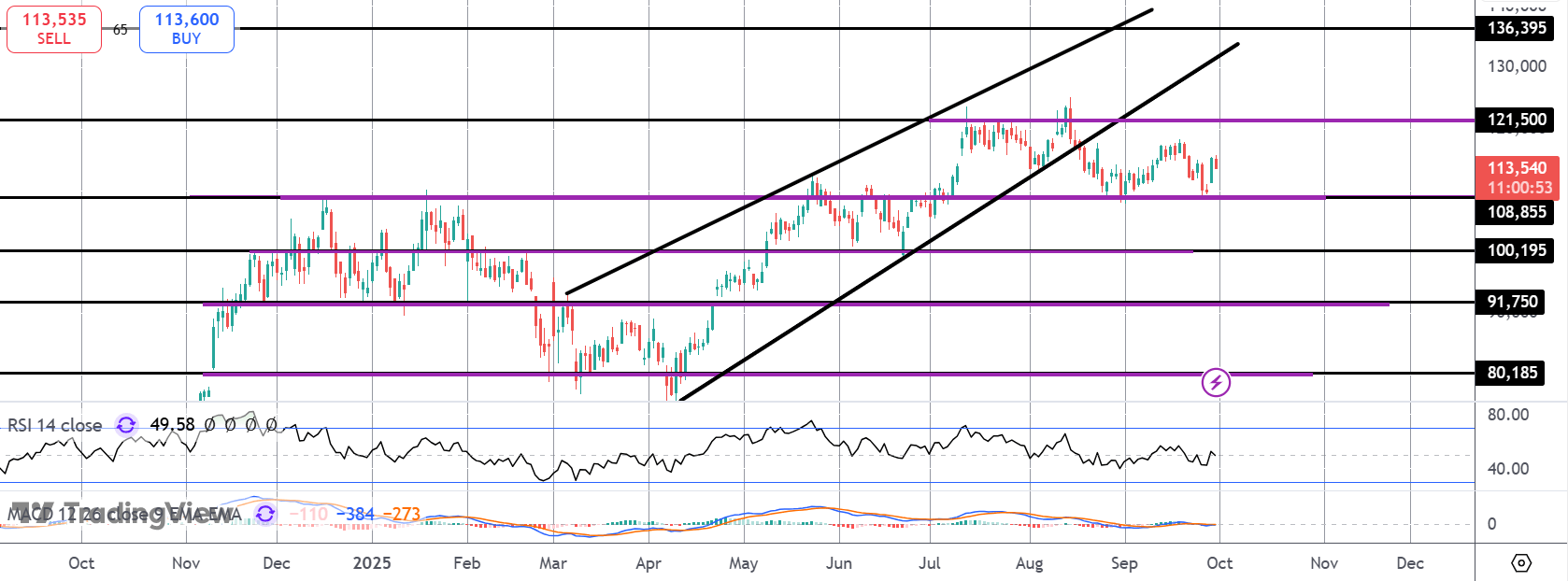

Bitcoin prices continue to trade within the $108,855 - $121,500 range which has roughly framed price action over the last three months. Yesterday the futures market gapped higher at the weekly open and rallied firmly to test the prior week’s opening level where the move has currently stalled. The latest ETF data shows a strong surge in inflows yesterday of around half a billion dollars’ worth. With ETF demand climbing, focus remains on an eventual break higher and a continuation o the bull trend that market Q1 and Q2.

US Shutdown Risks

Looking ahead, the main focus this week, at least initially, is on US govt shutdown risks. Trump warned yesterday that a shutdown looks likely now as a dela on fiscal plans remains elusive. If seen, BTC is at risk of a drop lower near-term given its strong correlation with traditional risk assets. Should stocks plunge as a shutdown is announced tomorrow, this could see BTC breaking below current range support. However, if a deal is agreed last minute and a shutdown avoided, BTC stands to rally firmly as risk markets cheer the result.

NFP Release In Doubt

Whether we see a shutdown announced will then impact whether we get the week’s headline data on Friday. The latest US labour reports will be delayed in the event of a shutdown which will exacerbate uncertainty among investors (given their importance to determining near-term Fed actions) and should weigh on BTC more. If a shutdown is avoided and the data is released on Friday, BTC bulls will be looking for further weakness to cement near-term easing expectations and push risk assets higher.

Technical Views

BTC

Following the downside break of the bull channel, BTC has failed to move below the $108,855 support. While this area holds, focus is on an eventual resumption of the uptrend and a topside break of $121,500 targeting $136,395 as the higher bull target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.