Weak U.S. Economic Data Sparks Dollar Retreat and Surge in Treasury PricesArthur

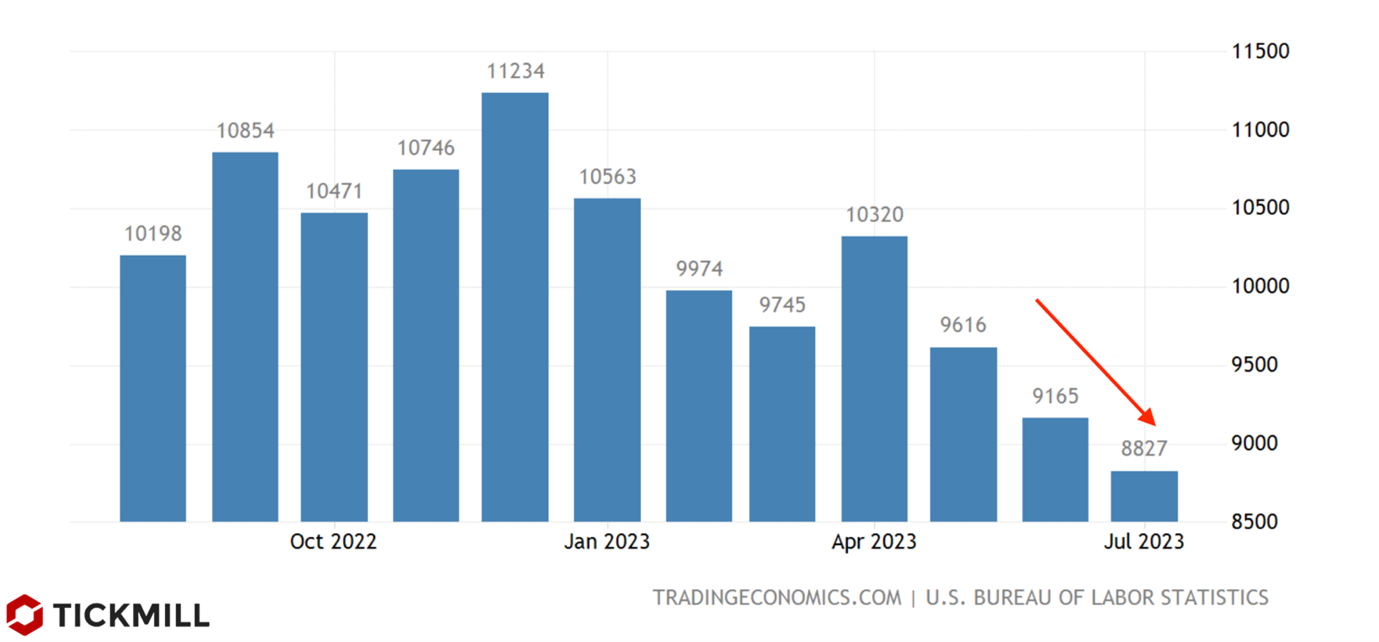

A batch of weaker-than-expected economic data from the United States yesterday and today has led to a significant inflow of investors back into Treasury bonds and reduced demand for the dollar. JOLTS reported that the number of job openings in July decreased to 8.8 million, indicating that there were approximately 1.5 open positions for every unemployed worker in the United States - the lowest ratio since September 2021:

The consensus forecast was 9.46 million, so the deviation is significant. Considering the labor market overheating after the pandemic (where demand for labor began to significantly outstrip supply, leading to significant consumer inflation), the JOLTS job openings data helps assess how this imbalance is changing. As seen from the latest data, the labor market continues to normalize, with the pace of reducing the imbalance accelerating.

Consumer confidence data also disappointed yesterday, with the corresponding index dropping from 117 to 106.1 points, against a forecast of 116 points. Such a sharp decline is usually associated with deteriorating household expectations regarding future incomes.

The parade of weak statistics continued today. Job growth according to ADP was 177K - well below the forecast of 195K. Unexpectedly, the second estimate of U.S. GDP for the second quarter came in significantly below expectations at 2.1% versus a forecast of 2.4%. Corporate profits for the quarter increased, but the price index calculated through GDP came in at 2% against a forecast of 2.2%.

Weak data has led to a sharp reassessment of the prospects for an additional Fed rate hike this year. The yield on 10-year Treasuries dropped by about 12 basis points from the middle of yesterday's trading session:

Increased demand for Treasuries boosted the supply of the dollar, and the yield differential between U.S. Treasury bonds and the sovereign debt of other countries changed unfavorably for the former, further reducing demand for the dollar. The euro and the British pound managed to gain over half a percent, and the dollar index fell to 103 points, returning to main bearish channel:

If tomorrow's NFP data confirm a deteriorating employment situation, a further downward correction of the dollar within the bearish channel can be expected, as market participants will increasingly anticipate the end of the Fed's tightening cycle.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.