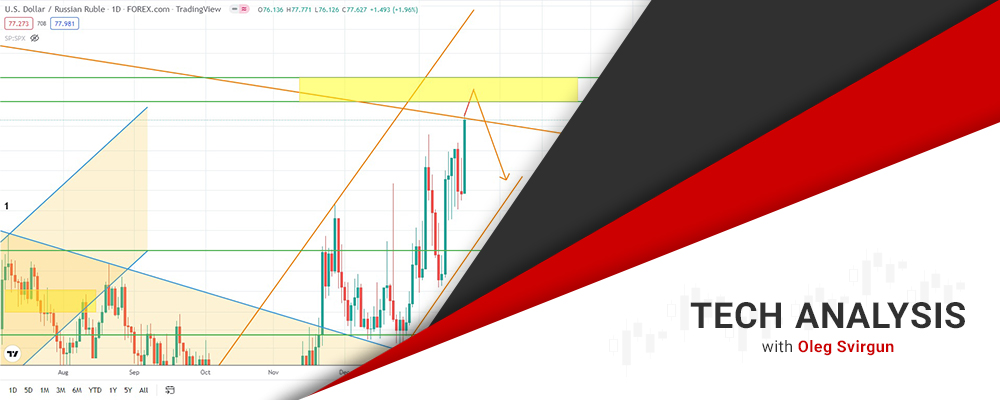

USD/RUB: Potential Reversal Ahead

The USD/RUB pair is approaching the resistance zone formed between the levels 78.00 and 78.50. Although it is not known yet how strong resistance the asset is about to face, it is likely that it might reverse and drop afterwards.

Having broken the resistance at the level of 86.70, oil pulled back to the broken trendline. At that point, the asset has formed a hammer on Friday. The handle of this hammer is touching the broken level. So, oil is likely to jump and hit the level of 96 US dollars per barrel soon.

The price of Euro has pulled from the downtrend and dropped. The asset’s price was consolidating for a while. Euro might test the downtrend and drop even further. This is likely to happen due to the presence of a reverse flag on both daily and weekly charts as this is a trend continuation pattern.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.