USD This Week: Govt Shutdown Fears & NFP Forecasts

USD Softer on Monday

The US Dollar is starting the week on a softer footing as fears over a potential US government shutdown loom this week. If the government fails to agree a new funding deal before the fiscal year ends tomorrow, leading to parts of the federal government closing on Wednesday. If seen, this will be firmly bearish for USD and could impact the release of Friday’s NFP data. Depending on the duration of the shutdown, the Fed’s easing cycle could become much harder to project, creating deeper cross-market volatility. However, if a last-minute deal can be agreed and a shutdown avoided, this should fuel a rebound in USD ahead of Friday’s data.

NFP Forecasts

Looking ahead to the labour market reports on Friday then. The market is expecting the headline NFP figure at 51k, up from 22k prior. Earnings and the unemployment rate are expected unchanged at 0.3% and 4.3% respectively. If data prints in line with forecasts, his should keep October easing prospects healthy, with jobs growth still at very weak levels. In this scenario, USD should weaken again into the following week as traders brace for a furtehr Fed rate cut in October. Given the built-up level of dovish expectations, it would likely take a heavy upside surprise (+100k) to cause any shift higher in USD on the back of the data.

Technical Views

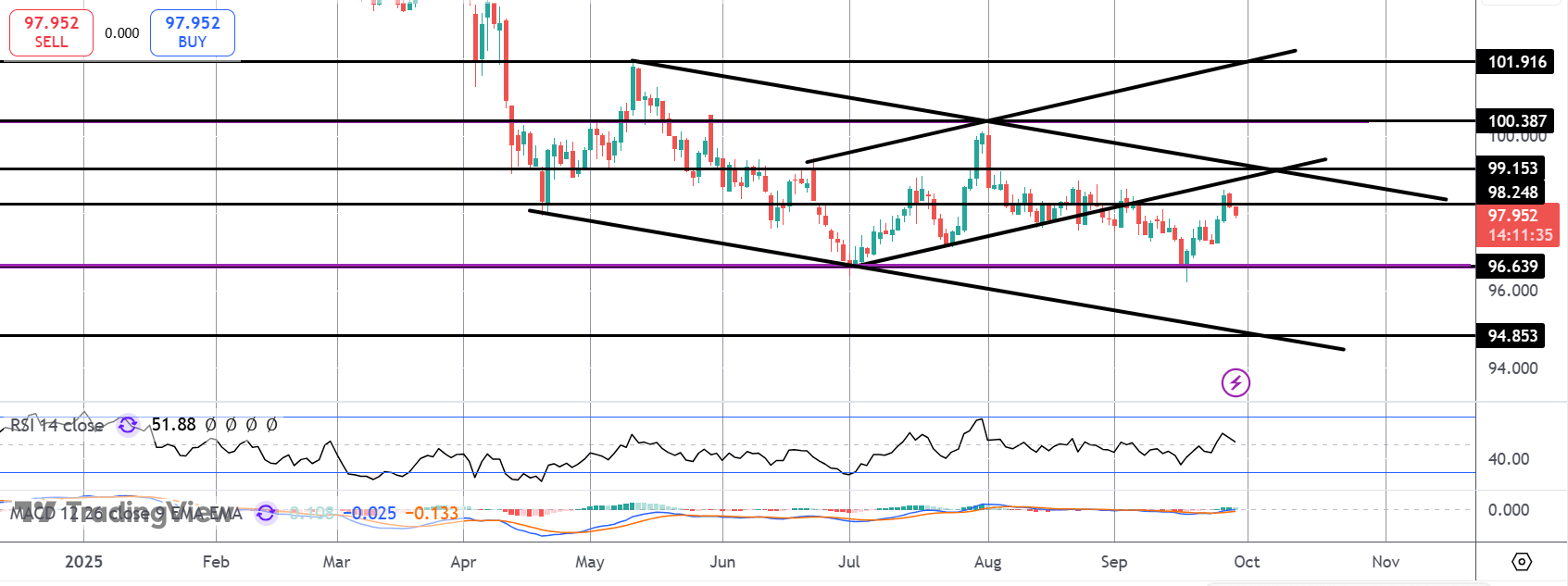

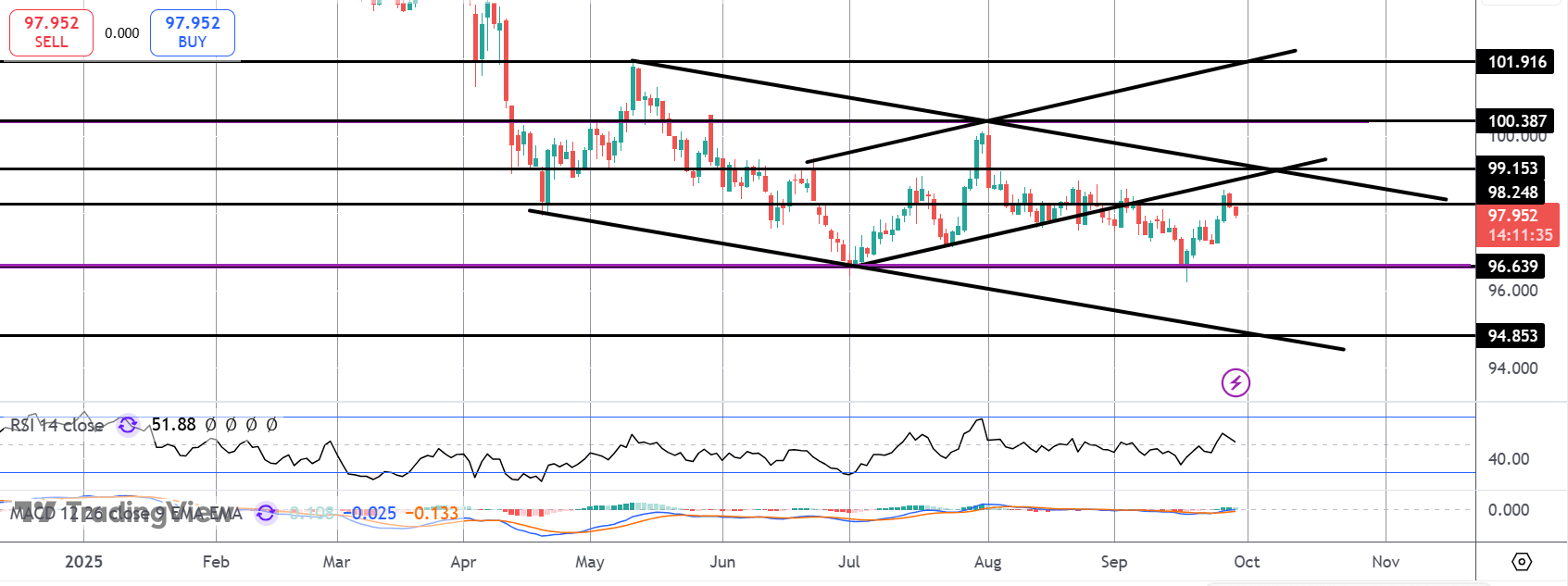

DXY

The index has turn back below the 98.24 level, failing just ahead of a retest of the broken bull channel lows and the bear channel highs. While these key resistance levels hold, focus is on a fresh push lower with 96.63 support the first objective for bears ahead of the deeper 94.85 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.