USD Soars As JPY & EUR Tank On Monday

USD Rallying as JPY Sinks

The US Dollar is trading firmly higher on Monday as political upheaval around the globe contributes to fresh safe-haven demand for USD. Indeed, this demand comes despite ongoing uncertainty in the US too amidst the current US government shutdown. Despite the situation in the US, however, focus this week is on the collapse of the French government after the PM stepped down and the seismic shift in Japanese markets after the LDP appointed fiscal dove Takaichi its new leader, now likely to become next Japanese PM. JPY has collapsed in response to thew news which has sparked a sharp shift in traders ’ BOJ expectations. The market now widely expects the bank to take a more dovish approach should Takaichi take over as the new PM/.

French PM Resigns

In France, newly appointed PM Lecornu stood down less than a day after appointing his cabinet fuelling a surge in political uncertainty. There is now a growing call for a snap election in France with the country facing the prospect of its sixth PM in just two years. EUR has turned sharply lower today in response to the news which, along with the move lower in JPY, has sparked a buying frenzy in USD which looks set to continue this week.

FOMC Minutes

Midweek, focus will turn to the incoming FOMC minutes. Given that the ongoing US shutdown means tier one data (such as the NFP0 will remain delayed for now, the minute swill be the headline focus and might cause some giveback in USD if they are seen falling on the dovish side.

Technical Views

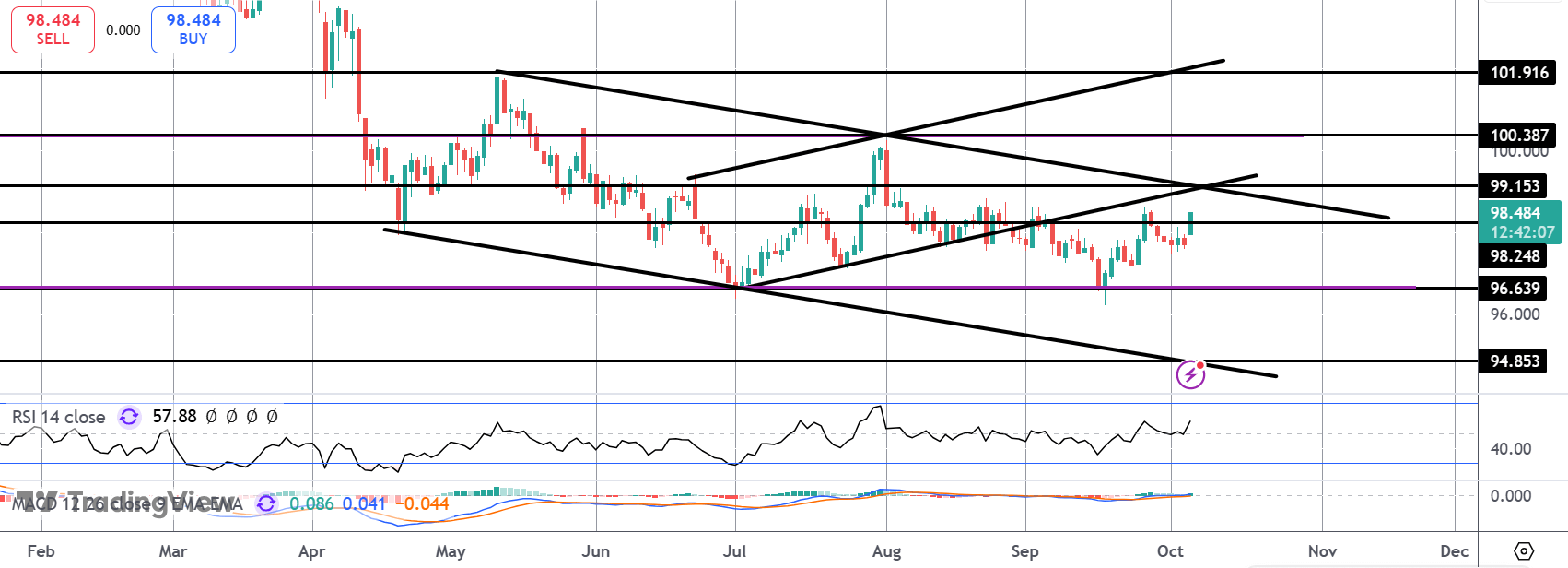

DXY

The rally off the 96.63 level is gathering pace again with the market now back above the 98.24 level. With momentum studies bullish focus is on furtehr upside for now though bulls have a big test ahead. The 99.15 resistance sees confluence between the broken bull channel lows and the bear channel highs. This is a key resistance zone which, if broken, will be a firmly bullish development putting focus back on 100.38 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.