US Dollar: Fed Rate-Cuts In Focus

Dollar Down Following Powell Comments

The US Dollar remains weak as we cross through the back of the week. DXY retreated from highs earlier this week on warnings from Fed chair Powell that the bank would soon be ending its QT program. Powell cited rising risks to the labour market as a guide for the need to support the economy. Raet cut expectations for this month remain well supported on the back of these comments with traders looking for at least .5% worth of easing split between this month and December. The absence of key US data amidst the ongoing US govt shutdown is making the Fed’s actions harder to gauge. However, a clear dovish tone from Powell this week means that risks are likely skewed to the downside for when the Fed meets in a fortnight’s time.

Weak Beige Book Data

The Fed beige book data (among the only releases not prevented by the shutdown) cemented this dovish view. The release showed that economic growth had softened last month with jobs weakening further as input prices rose. Though no major changes were noted against the prior month, the data was soft enough to suggest little reason that the Fed would refrain from easing again this month. As such, USD looks prone to a further drift lower as we approach the FOMC.

Technical Views

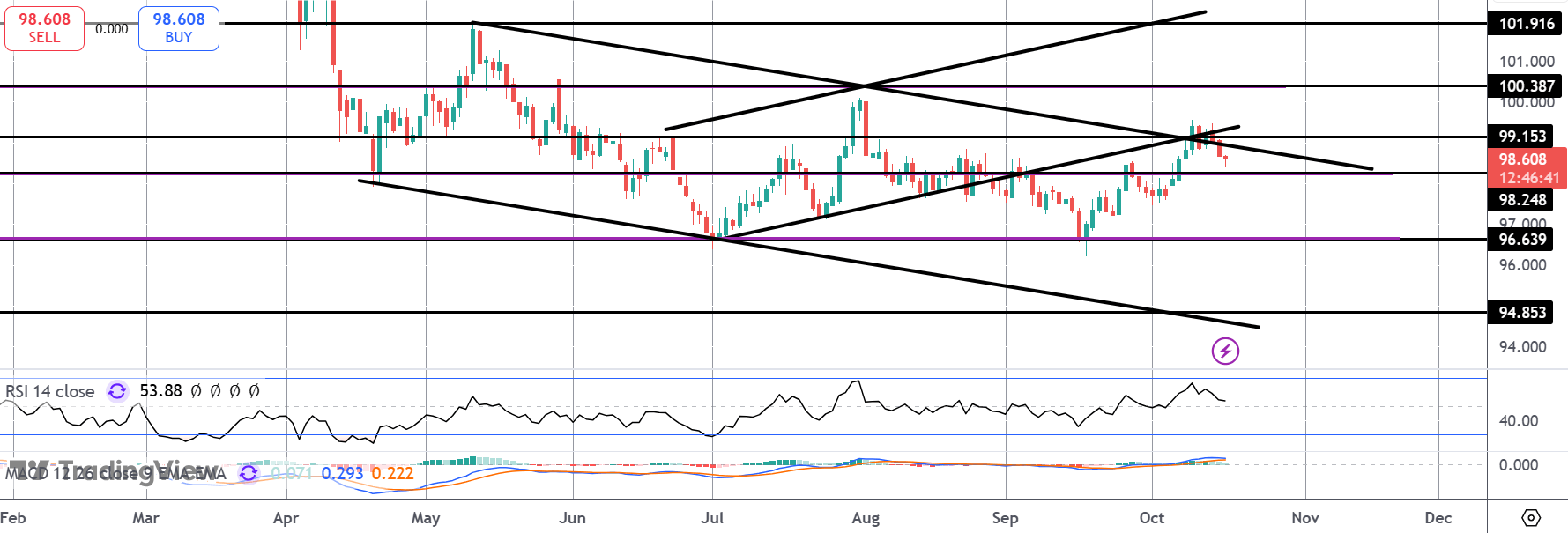

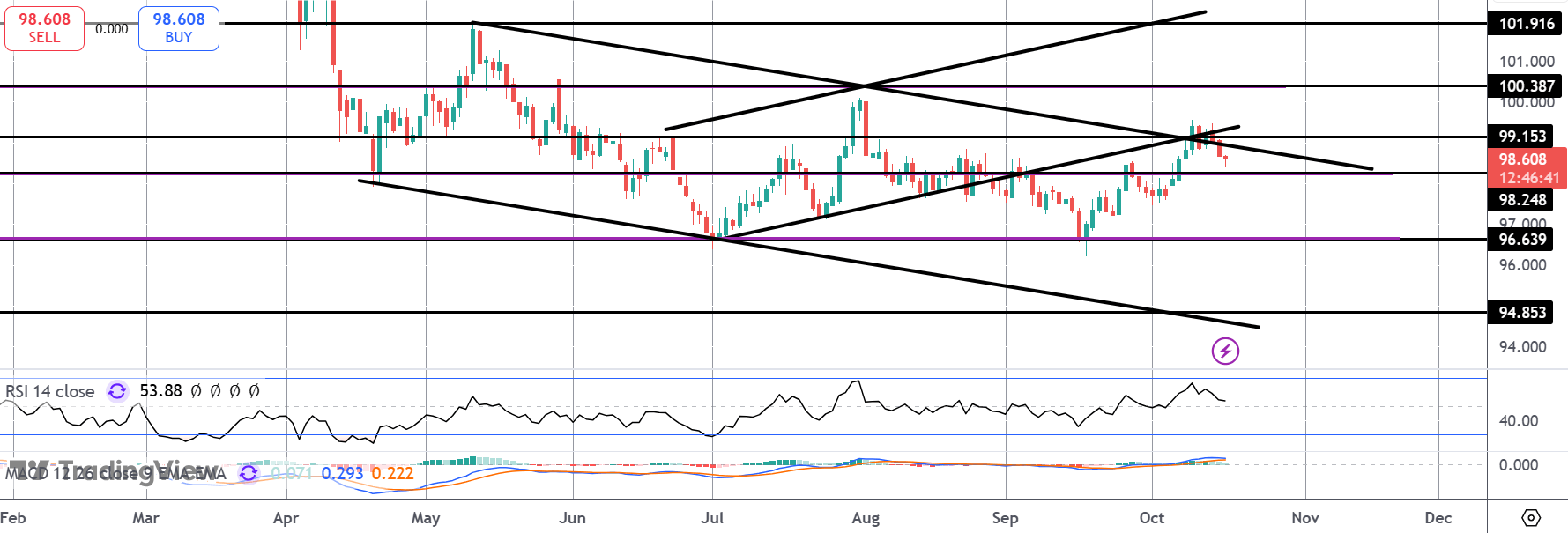

DXY

The rally in DXY has stalled for now into a key resistance area around 99.15 where we have the bear channel highs and retest of the broken bull channel lows also. While this level caps the market, risks of a fresh move down towards 96.63 are seen, with 98.24 first support ahead of that level. If we recover, however, 100.38 will be the initial bull objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.