The FTSE Finish Line - October 30 - 2024

The FTSE Finish Line - October 30 - 2024

FTSE Under Pressure As UK Budget Deals A Blow To Investor Sentiment

The UK's benchmark FTSE 100 index declined on Wednesday, weighed down by healthcare stocks after GSK forecast lower annual vaccine sales, while investors digested the current government's first budget, which delivered the largest tax increases in 30 years. The blue-chip FTSE 100 fell 0.5%. British finance minister Rachel Reeves announced large tax increases on the rich, betting she could fund higher spending on public services without damaging the economy and triggering a mass exodus of millionaires. The measures include raising the capital gains tax rate, making it harder to pass on assets without paying inheritance tax, and ending tax discounts used by wealthy individuals who bring in foreign income. The move is deemed politically risky as the new Labour government had spent months wooing the business elite ahead of its landslide election victory in July. Advisers to the super-rich have said some of their clients will quit Britain if the government increases taxes as money can be easily moved across borders and investors display little allegiance to individual countries. The government said it will increase capital gains tax on the performance fees that private equity fund managers make when assets are sold, known as "carried interest", to 32% from 28% at the higher rate. The capital gains tax changes also include raising rates for lower earners but keeping rates for property at the same rate as now.

In single stock stories GSK's shares declined due to a reduction in its annual vaccines forecast. The company's stock price has fallen by as much as 3.5%, reaching the lowest level since December 2023, and is among the top losers on the FTSE 100 index. The British drugmaker has cut its 2024 vaccine sales forecast, citing weak demand for its respiratory syncytial virus (RSV) and shingles vaccines. The company now expects full-year vaccine sales to decline by a low-single-digit percentage, compared to its previous forecast of low-to-mid-single-digit percentage growth. However, GSK reported better-than-expected third-quarter core earnings per share of 49.7p and sales of £8.01 billion, compared to analyst estimates of 43.6p and £8 billion, respectively.

AstraZeneca's shares decline after the president of its China operations is under investigation. The company's stock is among the top losers on the FTSE 100 index, falling 2.8%, the lowest since April 22. AstraZeneca states that its China operations continue under the current general manager while the president is cooperating with authorities, but provides no further details. Despite the day's drop, the company's stock is up around 6% year-to-date.

British bookmakers' shares rise as Reeves' budget leaves sector tax unchanged. Shares of Entain, Evoke, and Flutter gain as the Chancellor's maiden budget did not change taxes for the gambling sector. Shares had fallen sharply earlier after a report that the Labour government was considering a 3 billion pound tax raid on the gambling sector. Entain, Evoke, and Flutter are among the top gainers on the FTSE 100 and FTSE mid-cap indexes.

UK homebuilders' shares rise as finance minister delivers autumn budget speech; Britain's economy forecast to grow 2.0% next year, up from previous 1.9% projection; FTSE 100 homebuilders Persimmon, Barratt, Vistry and Taylor Wimpey gain between 1.5% and 2.4%, with Barratt up 2.4%.

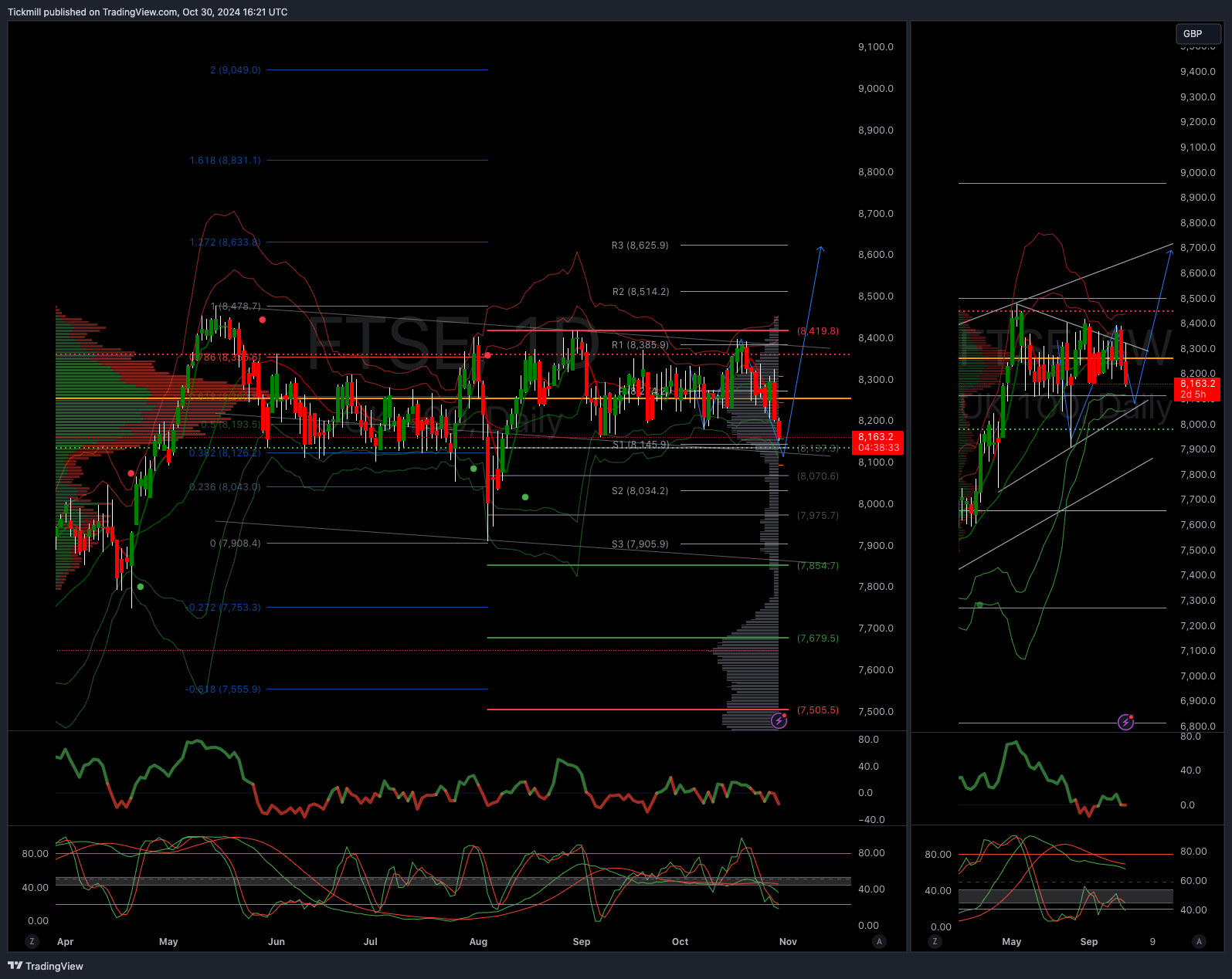

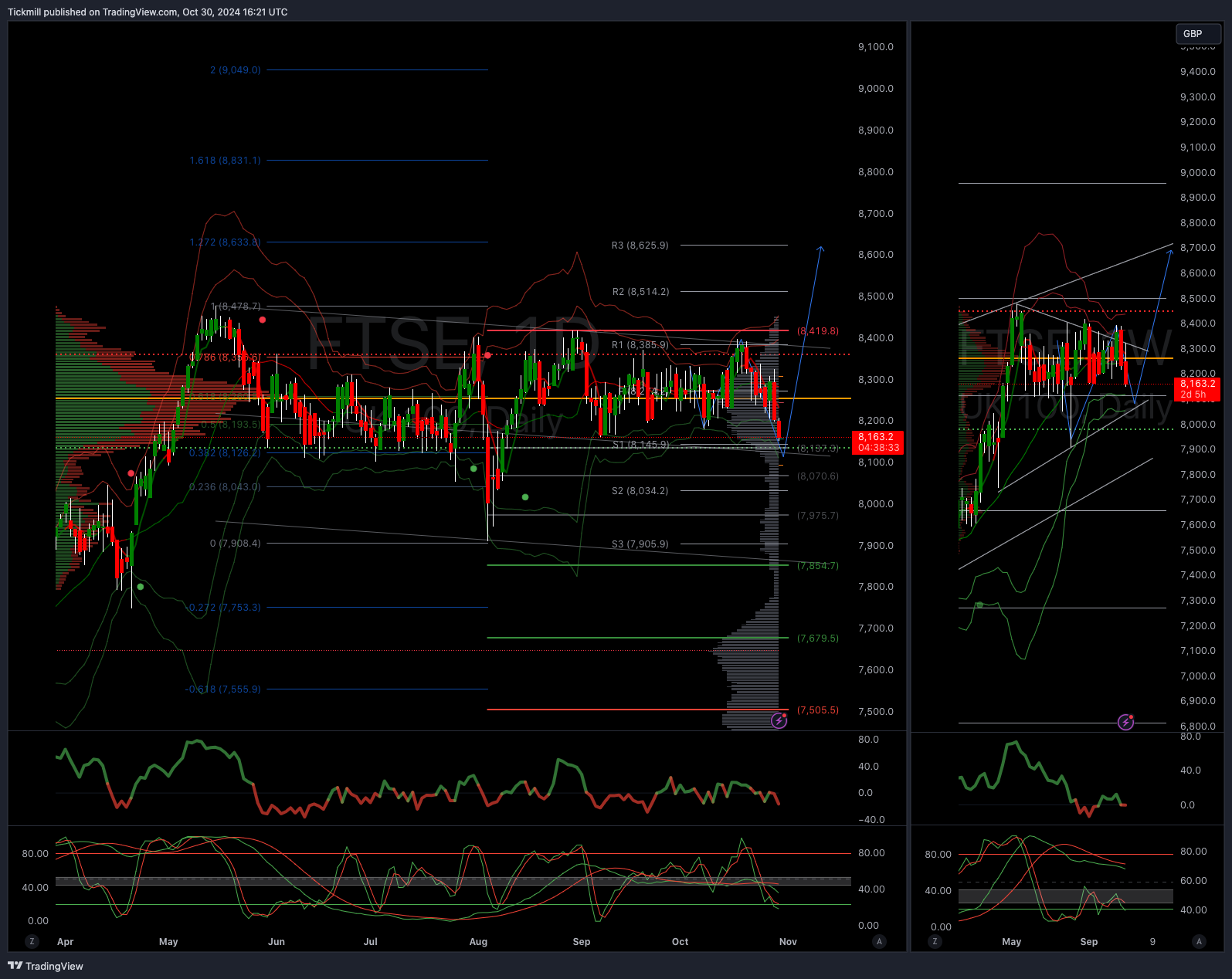

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8100

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!