The FTSE Finish Line - November 22 - 2024

The FTSE Finish Line - November 22 - 2024

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

FTSE Bid On Downbeat Data As Traders Bet On BoE Rate Cuts

The FTSE 100 outperformed other European markets due to renewed expectations of interest rate cuts, despite disappointing economic data. The benchmark index is trading above 8,200, the highest level since late October, with more than 10% of its constituents recording gains of over 3%. Retail sales declined 0.7% in October, a much larger drop than the expected 0.3% decline, following a 0.1% rise in September. S&P Global PMI readings for Manufacturing and Services unexpectedly declined in November, and the Composite reading also unexpectedly slipped into contraction territory.

Single Stock Stories:

Shares of British retailer DFS Furniture increased by 1.7%. The company says order intake continued to grow over the first 20 weeks of the half-year, in line with its expectations. DFS Furniture has appointed Marie Wall as interim Chief Financial Officer, effective from December 2. Marie Wall has previously held senior finance roles at Imperial Brands, Wolseley, and Dixons Carphone. There is great operational gearing here, and if trading at Christmas surpasses last year, we could be in upgrade territory. The stock has risen approximately 11% year-to-date.

Broker Updates:

According to a survey by JPMorgan that surveyed 5,000 consumers across Germany, France, Spain, UK and U.S., the UK consumer appears weaker compared to other countries. The survey found that 50% of UK respondents feel worse off financially after the Labour Budget, while only 14% expect to be better off. As a result, UK consumers expect to spend less on discretionary items in the near future. JPM maintains its preference for Marks & Spencer in the UK, with an overweight rating, and reiterates its negative stance on UK home improvement company Kingfisher, which has an underweight rating. In food retail, downtrading continues, but JPM says the survey results read positively to Tesco, which they are underweight on, suggesting the consumer finds value in its proposition.

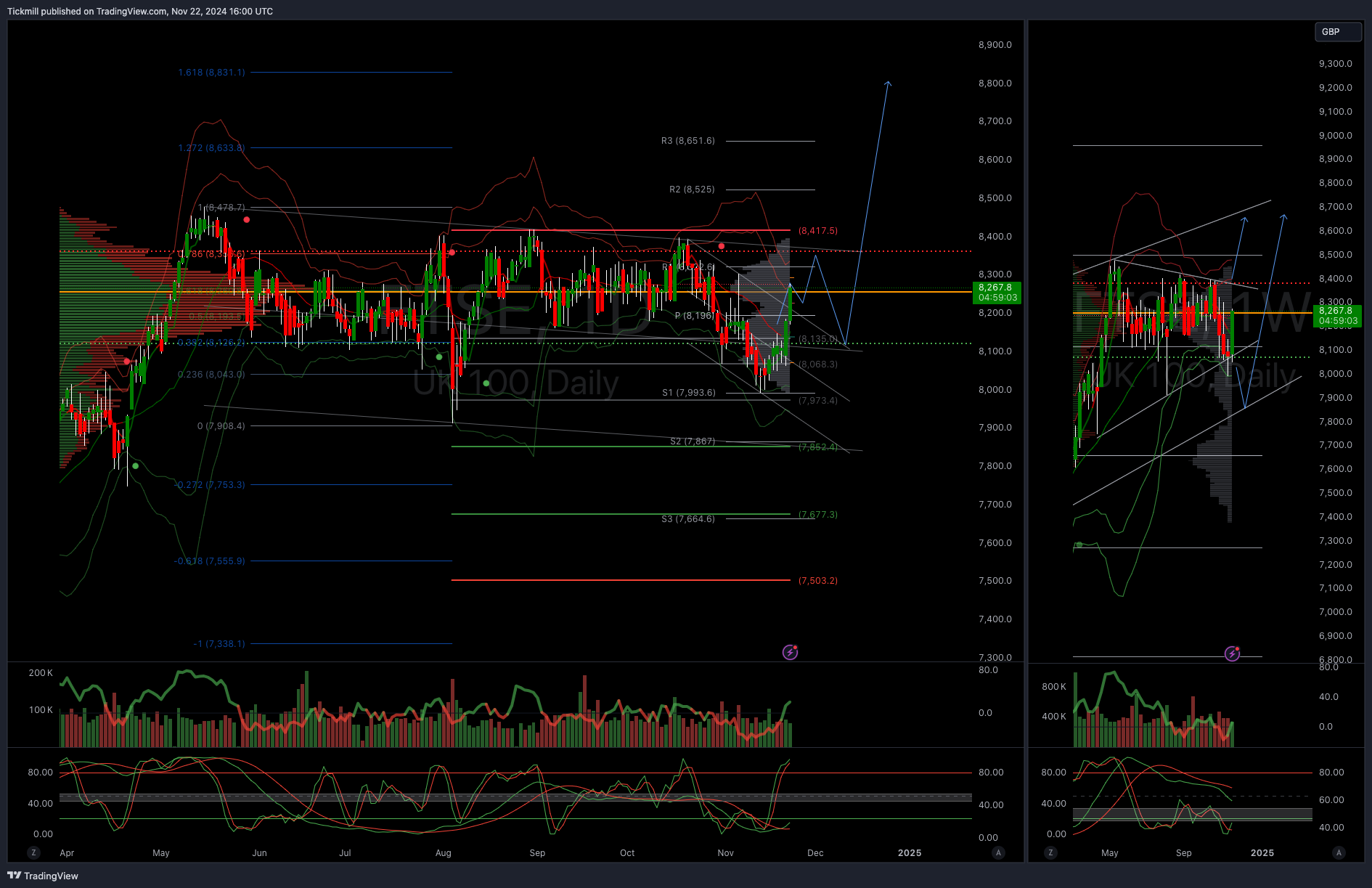

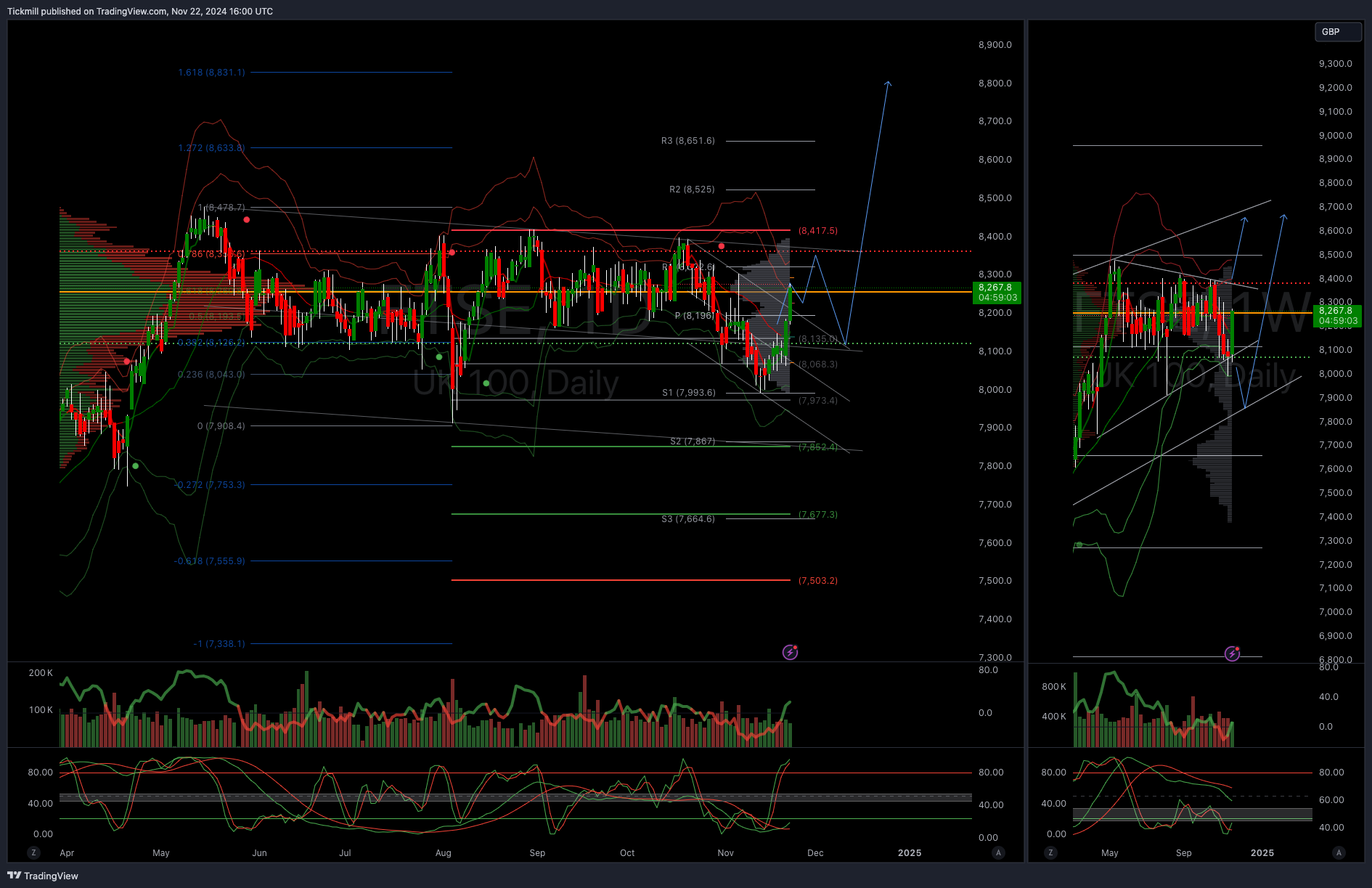

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!