The FTSE Finish Line - November 13 - 2024

The FTSE Finish Line - November 13 - 2024

FTSE Flat To Down As Bears Eye 8000 Test

Wednesday saw a fall in the top UK stock indices as investors processed important U.S. inflation data to see how monetary policy would proceed. The path towards low inflation has slowed since mid-year, which may result in fewer interest rate reduction from the Federal Reserve next year. In October, U.S. consumer prices increased as expected due to increasing shelter costs, such as rents. Following Donald Trump's re-election as president of the United States, investors were dissatisfied with China's stimulus measures and concerned that a trade war would harm the European economy, which led to volatility in the UK and European markets. Meanwhile, interest rate-setter Catherine Mann of the Bank of England warned that the country's persistently high inflation raises the possibility that some of the factors driving price growth may be moving upward. Last week, the BoE lowered borrowing prices for just the second time since 2020 and stated that additional cuts would probably be made gradually while it evaluated how persistent inflationary pressures were.

Single Stock Stories:

Shares in Smiths Group surge up to 19.4% to a record high, leading the FTSE 100 index in percentage gains. The UK engineering firm raises its annual organic revenue growth outlook to 5-7% from the previous 4-6% forecast, and expects a 0.40 to 0.60 percentage point increase in its 2025 operating profit margin. The company has also increased its buyback programme to 150 million pounds from 100 million pounds after deciding not to pursue a potential acquisition it was considering. The stock had fallen around 14% so far this year prior to the latest close.

The UK-based alternative asset management announces an 18% loss in high-yield group earnings before tax of 198.4 million pounds ($252.6 million), while Intermediate Capital Group drops 6.8% to 2,088p, the highest percentage decline on the FTSE 100 index. The firm retains the medium-term outlook. As of September 30, there were $106 billion in assets under administration, a 4% increase from March 31. Stock up about 24% so far this year.

Babcock, a British defence company, experiences a significant surge in its share price, reaching as high as 594 pence, the highest level in over four years. The company reports a 10% jump in underlying operating profit to 169 million pounds and an 11% increase in revenue to 2.41 billion pounds during the first half of the year. Babcock is on track to meet its fiscal year 2025 expectations, driven by growth in its nuclear and land divisions. The company's shares have risen approximately 40% year-to-date.

Technical & Trade View

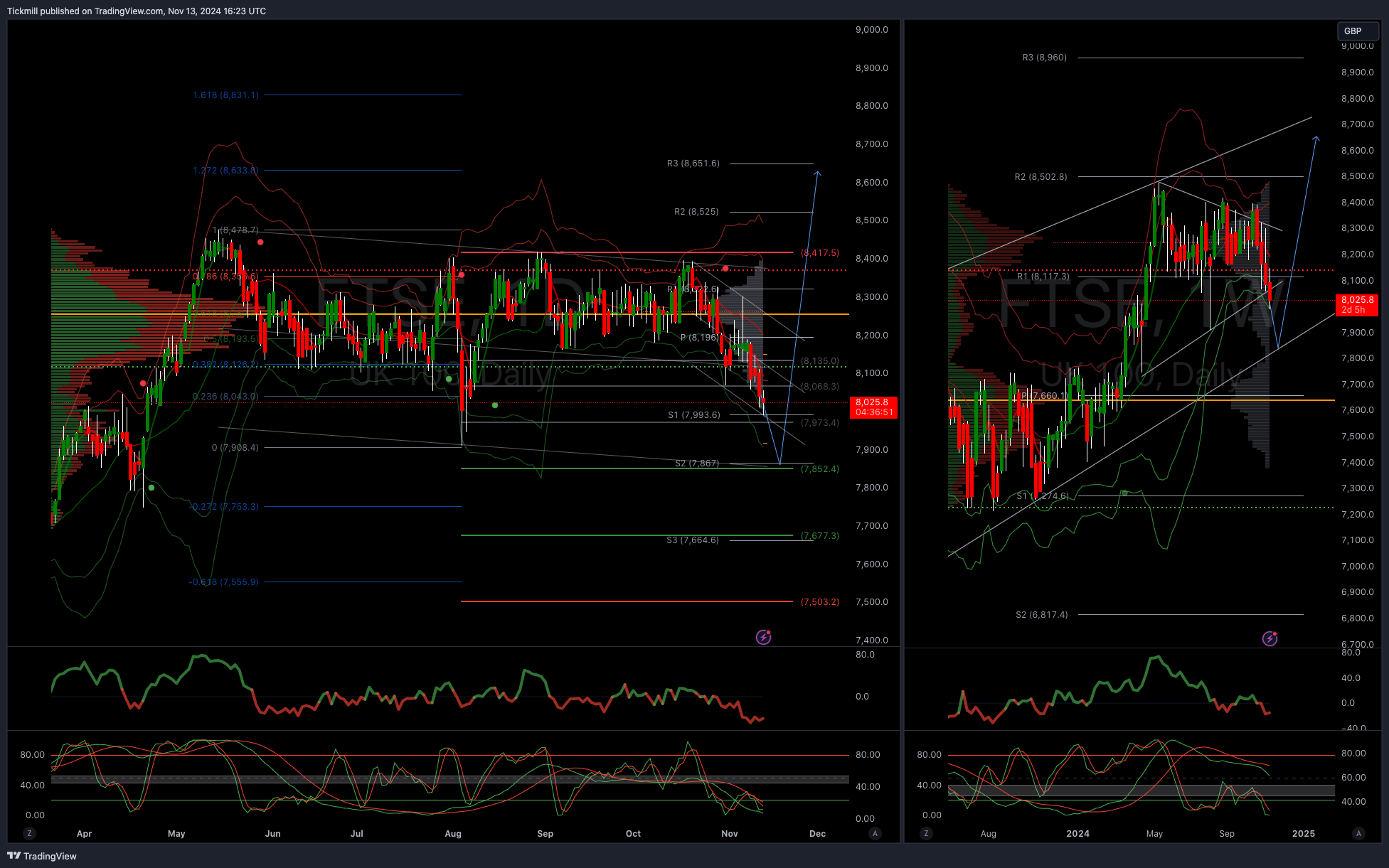

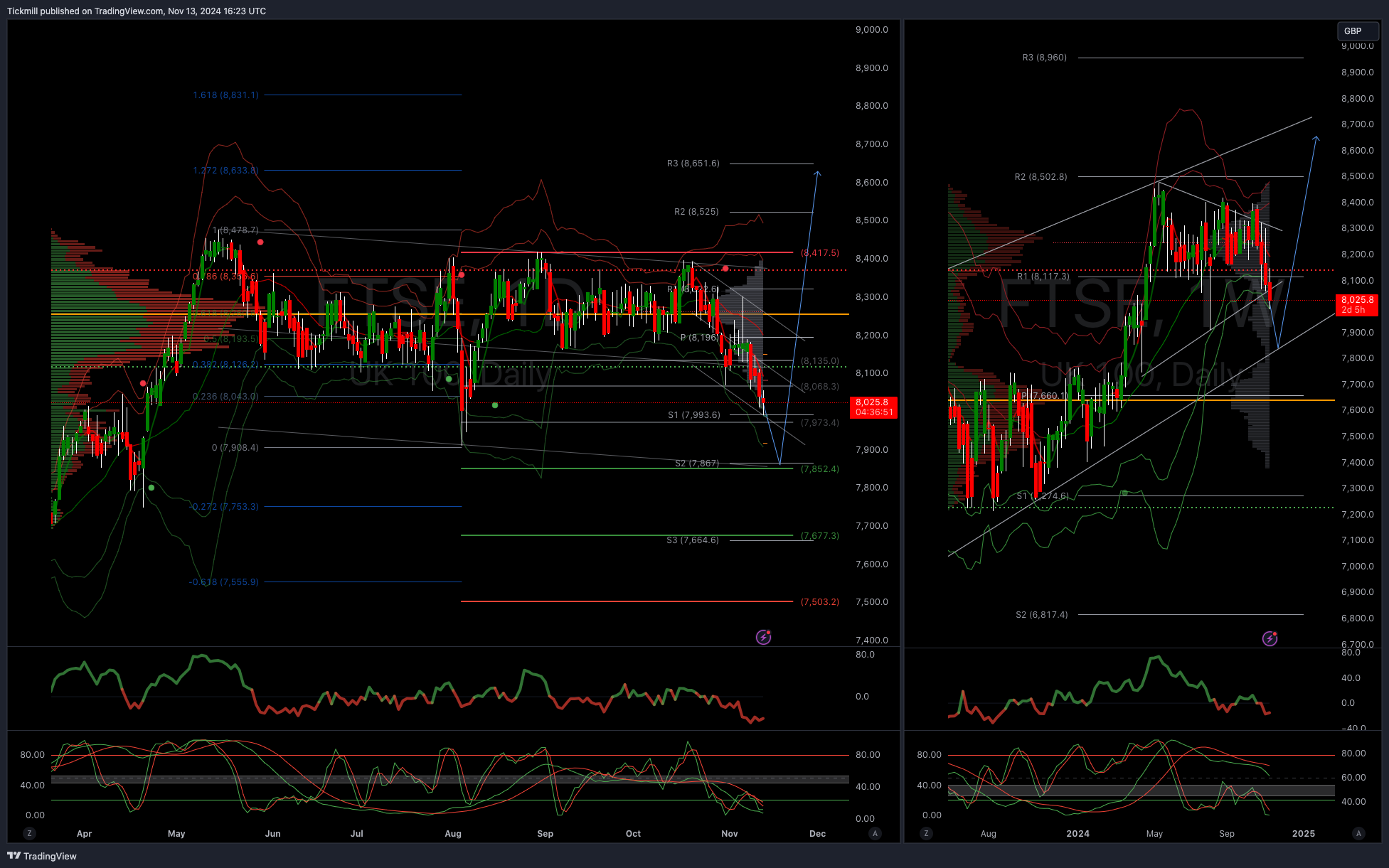

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!