The FTSE Finish Line - June 21 - 2024

The FTSE Finish Line - June 21 - 2024

FTSE Faltering As Rate Cut Hopes Fade WIth Retail Sales Strength

On Friday, London's FTSE 100 experienced a decline following a strong report on British retail sales, which led investors to believe that any potential rate cut would be postponed. However, the index was still on track to achieve its first weekly gain in six weeks. In morning trade, the FTSE 100 was down 0.3%, while the mid-cap FTSE 250 remained steady and was set to record its first weekly gain in four weeks. In May, British retail sales volumes increased by 2.9%, bouncing back from a revised 1.8% decline in April, surpassing economists' forecast of a 1.5% increase. The personal goods sector was the top performer among FTSE 350 sectors, with a 1% advance. Investor confidence in Britain is slowly improving following statements from the Bank of England on Thursday, which have raised the possibility of an interest rate cut in August. Markets are currently estimating a 50-50 chance of a rate cut in August.

British water utilities and Severn Trent shares are up by approximately 2% following an upgrade by JP Morgan. Both companies are among the top gainers on the FTSE 100 index. On June 20, JP Morgan upgraded UU to "overweight" from "neutral" and SVT to "Neutral" from "Underweight". The regulatory decision on price review expected on July 11 is anticipated to boost the sector's growth, as it will drive more investment to enhance environmental performance. As of the last close, UU has fallen 6.3% YTD, while SVT fell 5.3%.

ITV's shares surged 3.2% to 79.95 pence after J.P.Morgan raised its price target for the British broadcaster to 120p from 112p and maintained an "overweight" rating. The brokerage also upgraded its ad growth view to 5% from 0.4% and EPS by 16%, citing the potential boost from the final round of Euros in July. J.P.Morgan continues to have a positive outlook on ITV's advertising growth in the medium term. The stock is up 21.2% year-to-date as of the last close.

Wizz Air's shares dropped 4% to 2,238p following Barclays' downgrade from 'equal-weight' to 'underweight'. The stock is the top loser on the FTSE midcap index. Barclays stated that the revenue trends for low-cost carriers are not as strong as expected, while upscale carriers are not weakening as much. Wizz Air's peers Easyjet, ICAG, and JET2 also saw a decrease in their stock prices. Wizz Air's stock has risen approximately 1.5% year-to-date.

Britvic's stock surged 12.5% to 1,142 pence after rejecting Carlsberg's sweetened takeover offer of $3.93 billion, stating that it undervalues the company. Carlsberg's second offer was at 1,250 pence-per-share. Other British soft drink makers Fevertree and A G Barr also saw increases in their stock prices, while Carlsberg's shares fell by 5%. Britvic's shares were up 20% year-to-date as of the last close.

UK's Crimson Tide is experiencing a surge in its stock price following a buyout proposal from Ideagen worth 20.5 million pounds. The offer price of 312 pence per share represents a 76% premium to Crimson Tide's last closing price on June 20. The company's stock has risen by 52.1% to 270 pence during afternoon trade, the highest level since August last year. Crimson Tide's stock is also up by 24.6% year-to-date.

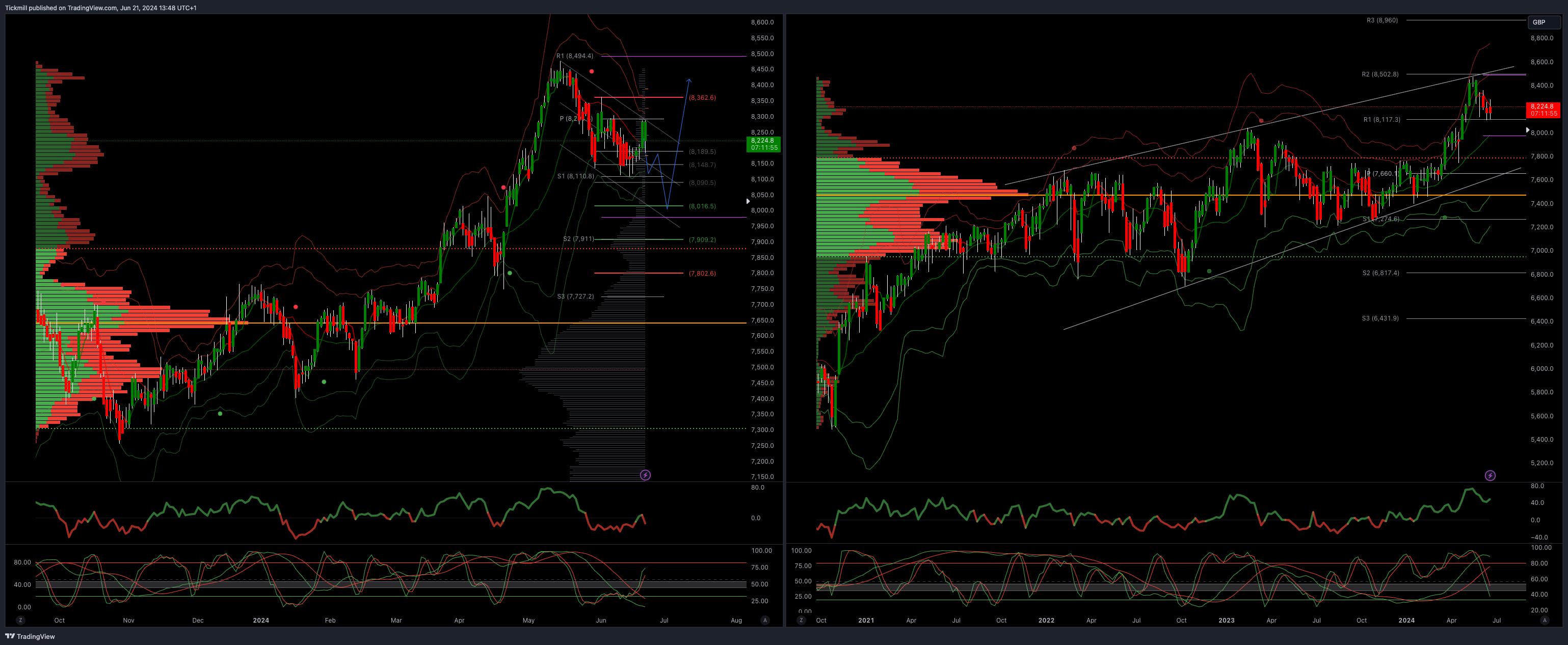

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8300

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bullish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!