The FTSE Finish Line: January 27 - 2025

The FTSE Finish Line: January 27 - 2025

FTSE Heading For A Green Close After Reversing Early AI Led Losses

Investors prepared for the Federal Reserve's interest rate decision later this week, leading to a quiet start to the week for British stocks as industrial metal miners pulled the index down. Technology stocks had the largest negative impact on the midcap FTSE 250, which declined. The benchmark FTSE 100 managed to reverse early losses, benefiting from its tech underweight status. The immense popularity of a low-cost Chinese artificial intelligence model triggered a selloff in shares related to AI. The industrial metal mining sector reached a two-week low, weighed down by a 6% decline in Anglo American following a report indicating that BHP Group will not pursue a new bid for the company.

Single Stock Stories:

Following the U.S. President Donald Trump administration's decision to retract a proposed ban on menthol cigarettes, cigarette companies like British American Tobacco and Imperial Brands experienced respective increases of 4.6% and 1.4% in their stock values. This positive development led to the food, beverage, and tobacco sector emerging as the top-performing sector, registering a notable 1.7% surge in performance.

Costain Group, a British construction and engineering company, saw its shares climb by 5.6% to reach 90.8 pence, positioning it as the leading gainer on the FTSE small-cap index, notwithstanding the index's 0.3% decline. Despite industry uncertainties, Peel Hunt reports that Costain is on track to achieve an operating profit for 2024 within the market's expected range of £41.9 million to £43.3 million. The company concluded 2024 on a positive note, with its order book increasing from £3.9 billion in 2023 to £5.4 billion. Peel Hunt analysts anticipate that advancements in projects like Rail (HS2 Euston) and Water will further bolster Costain's growth trajectory, complemented by enhancements in profit margins through internal initiatives. Notably, the stock experienced a remarkable 64.6% surge in value over the course of 2024.

Broker Updates:

WH Smith's shares surged by 5.6%, making it the top gainer on the FTSE mid-cap index, despite the index itself being down by 0.6%. Over the weekend, the company announced its exploration of strategic alternatives for its UK high street business, potentially including a sale, without specifying a valuation. Analysts from Barclays suggest that divesting the High Street segment could transform WH Smith into a rapidly expanding travel-oriented company, generating broader interest from investors. SMWH's high street division is a crucial component of its more lucrative travel operations. This positive development comes after the stock experienced a 9.3% decline in 2024.

Technical & Trade View

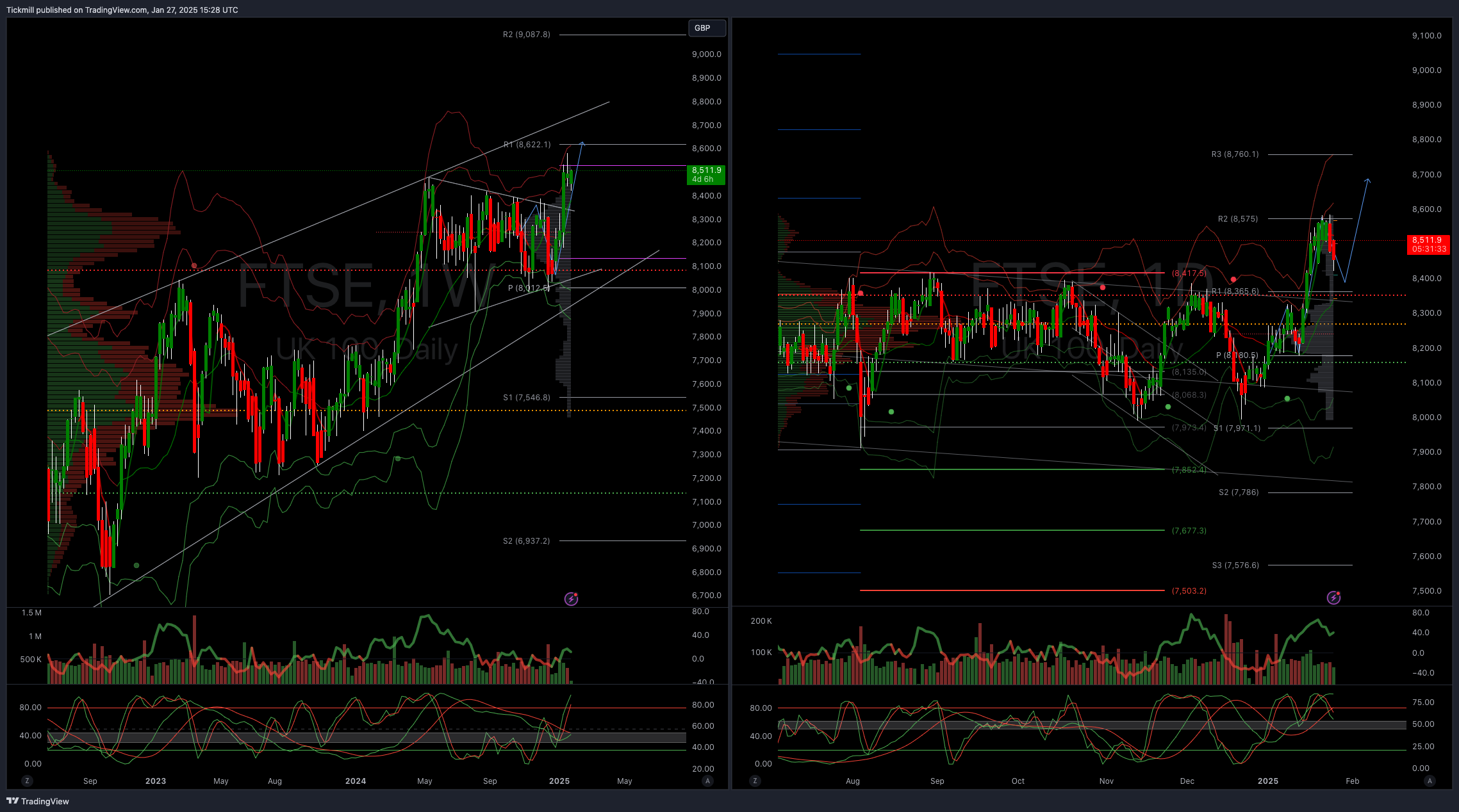

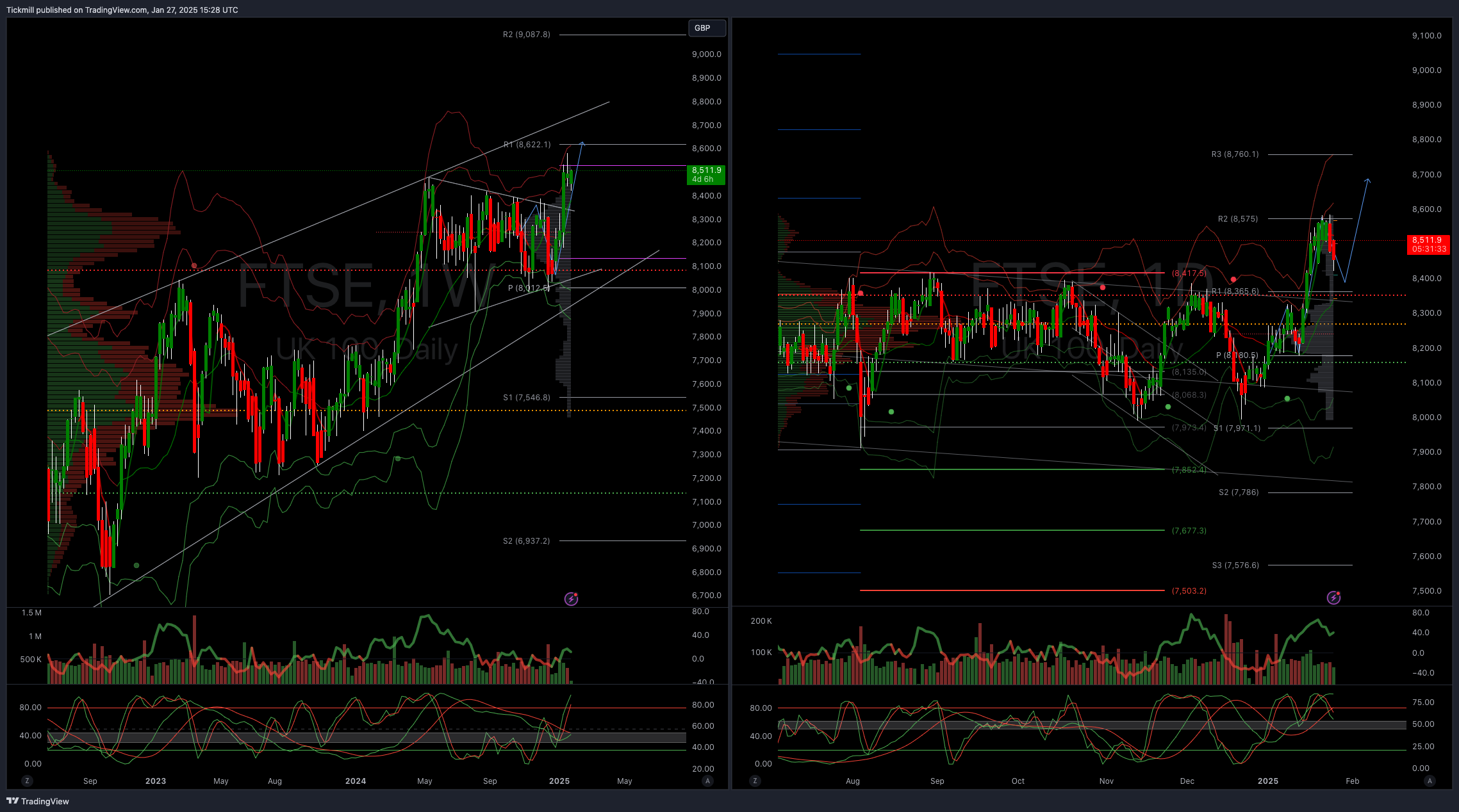

FTSE Bias: Bullish Above Bearish below 8400

Primary support 8400

Below 8400 opens 8225

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!