The FTSE Finish Line: February 13 - 2025

The FTSE Finish Line: February 13 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

FTSE In The Red As Heavyweight Profit Taking Weighs

London's leading index fell on Thursday, weighed down by declines in consumer staples such as Unilever and British American Tobacco, while a stronger pound pressured export-reliant stocks. The FTSE 100 dropped 0.7% as the pound gained strength following unexpected signs of improvement in the UK economy in late 2024. Despite this, the economy remains fragile, with another quarter of stagnation falling short of the growth promised by the government. "There is always the possibility that these figures could be revised, but for now, it seems the UK has narrowly avoided the grim label of a technical recession," noted Huw Pill, Chief Economist at the Bank of England. He also told Reuters that the central bank must tread cautiously when considering interest rate cuts, as the prolonged effort to rein in inflation continues.

Single Stock Stories & Broker Updates:

Unilever's shares have emerged as one of the largest decliners in the FTSE 100 index, dropping 5.3% Analysts have suggested that to mitigate the risk of "flow-back"—where investors sell shares in a foreign company back to domestic investors—a clean sale, joint venture, or dual US/UK listing for the company’s ice cream operations in Amsterdam, London, and New York would be preferable. The company forecasts a slower start to 2025 due to subdued short-term market growth. Unilever expects its underlying sales growth for 2025 to fall within its multi-year range of 3% to 5%, compared to the company-compiled estimate of 4.3%. Despite owning popular brands such as Magnum and Wall's, Unilever has faced challenges. Its Q4 underlying sales growth reached 4%, missing the company-compiled estimate of 4.1%. Year-to-date, Unilever’s stock (ULVR) has declined approximately 1%. In response, the company has initiated a €1.5 billion ($1.56 billion) share buyback program to bolster shareholder confidence.

British American Tobacco shares fell 6.5%, potentially marking their largest intraday loss since Dec 2023. The FTSE 100 index rose 0.34%, with BAT as the top percentage loser. A Canadian lawsuit cost the company £6.2 billion ($7.76 billion). After missing annual revenue forecasts, BAT warned of "significant" 2025 headwinds in Bangladesh and Australia. 2024 revenue stood at £25.87 billion and adjusted EPS at 362.5p, slightly below forecasts of £26.11 billion and 362.2p. Despite this, BAT shares rose 25.4% in 2024.

Shares in Barclays fell ~5% despite strong full-year results, closing at 292.8p and ranking among the top losers on London's index. The bank expects a ROTE of about 11% in 2025, above analyst forecasts of 10.8%. PBT for the year ending December 31 was 8.1 billion pounds, exceeding the 8.07 billion pounds average forecast. Analysts note the decline is harsh given the bank's strong performance, but profit-taking was anticipated due to high expectations. The stock is up ~9% YTD.

Technical & Trade View

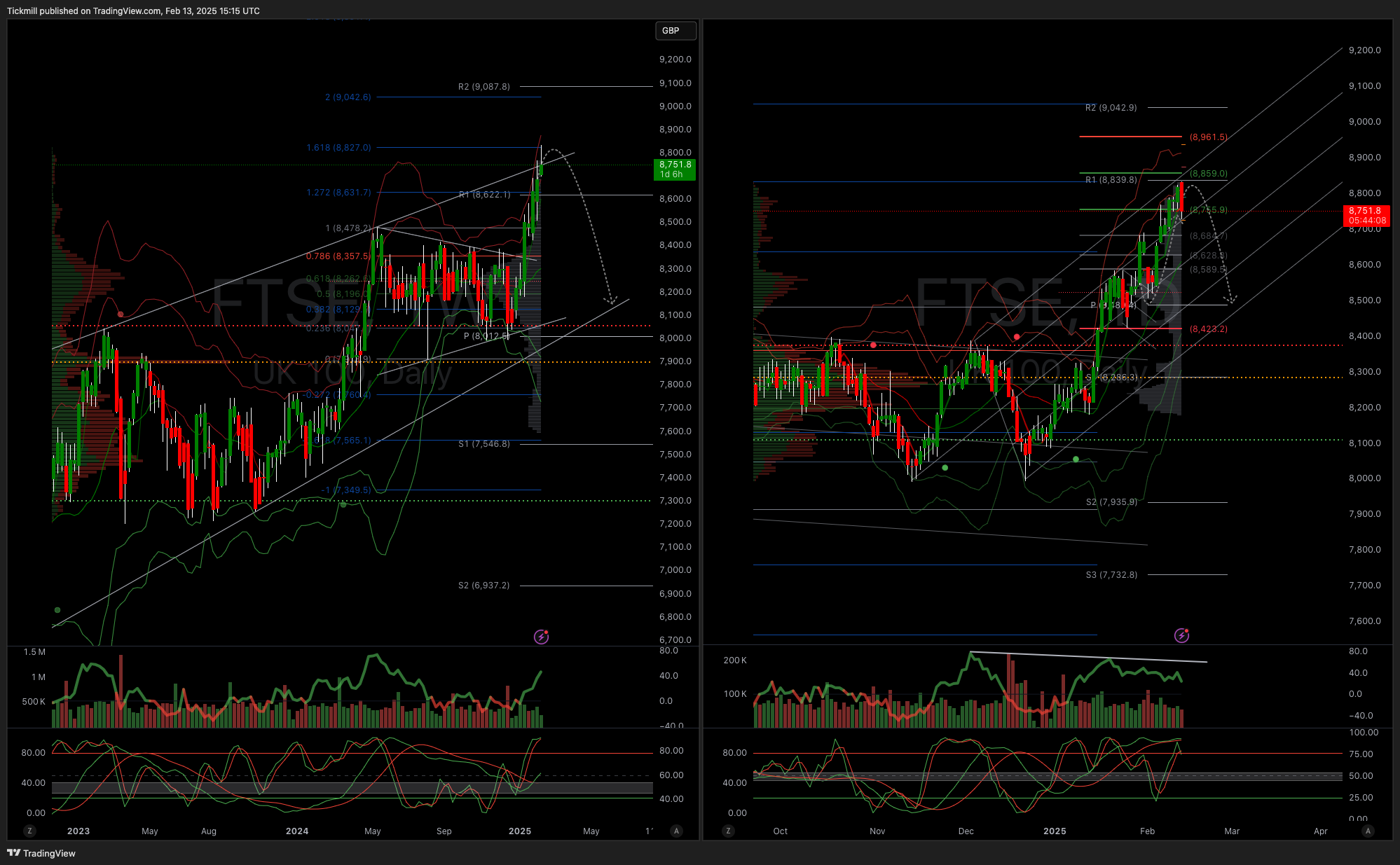

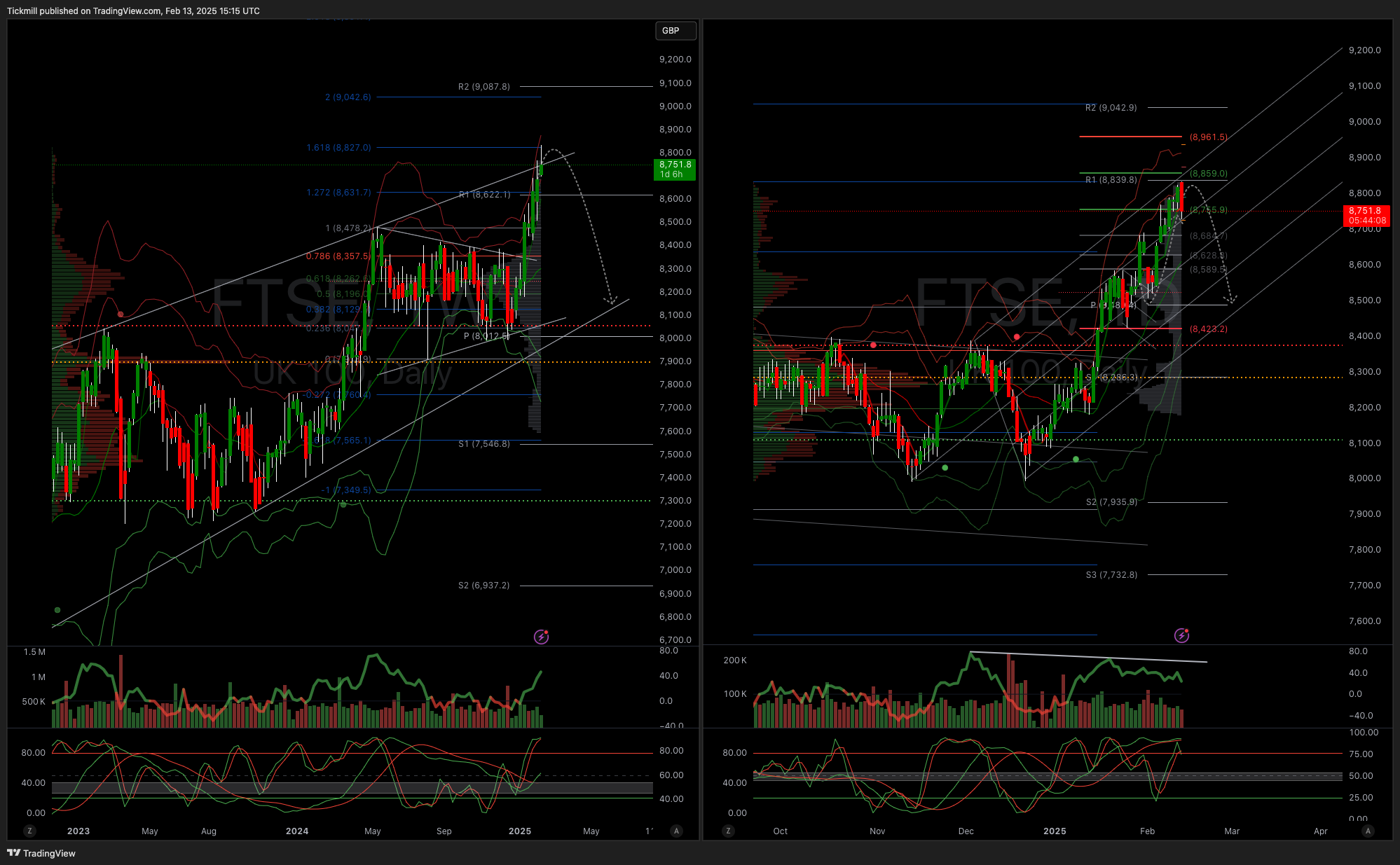

FTSE Bias: Bullish Above Bearish below 8400

Primary support 8400

Below 8400 opens 8225

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!