The FTSE Finish Line - August 06 - 2024

The FTSE Finish Line - August 06 - 2024

FTSE Turn Around Tuesday…Just!

The FTSE 100 index saw a 0.13% increase after seeing its largest decline in over a year on Monday. In the previous session, it reached its lowest point in more than three months. Investors flocked to safe-haven assets during a sell-off that rocked markets throughout the world as weaker U.S. statistics over the past week heightened fears of a recession in the largest economy in the world. Nonetheless, data released on Monday indicates that U.S. services sector activity increased in July, rebounding from four-year lows. Additionally, remarks made by Fed governors helped calm markets and reduce some losses.

Abrdn shares jump as the asset manager reports assets in line with estimates. Abrdn, a British asset management, is up 5%. reports total assets for the six months ended June 30 of 505.9 billion pounds ($644.42 billion), much in line with projections. HY Adj pretax profit increased to 170 million pounds from 151 million pounds the previous year. On ABDN's 800 million pounds in net inflows over the first half of the year, Jefferies analysts note, "The flow picture is actually stronger, albeit on tiny numbers, than projected." Stock lost approximately 6% YTD.

The online rental company OpenRent and the British real estate web Rightmove could not agree on membership terms, therefore the two parties announced on Tuesday that their contract will end on September 1. Shares of Rightmove, a London-listed company, had dropped 5.4%, making it the largest loss on the FTSE 100 index. Nonetheless, the business stuck to its yearly revenue and margin projections. In July, OpenRent accounted for 8% of Rightmove's lettings listings and almost 700 branch equivalents.

Holiday Inn's parent company, InterContinental Hotels Group, saw a 2% increase in share price, placing it among the top gainers on the FTSE 100 index. Revenue per available room (RevPAR) increased by 3.2% in the second quarter of the year, according to the firm, after growing by 3% in the first half. CEO Elie Maalouf said that the company's global reach, robust US recovery in the second quarter, and ongoing development activity were all factors in the latest quarter's RevPAR growth acceleration. IHG increased its interim dividend by ten percent and saw a 12% increase in operating profit from reportable segments in the first half of the year. The stock was up 3.7% so far this year as of the most recent close.

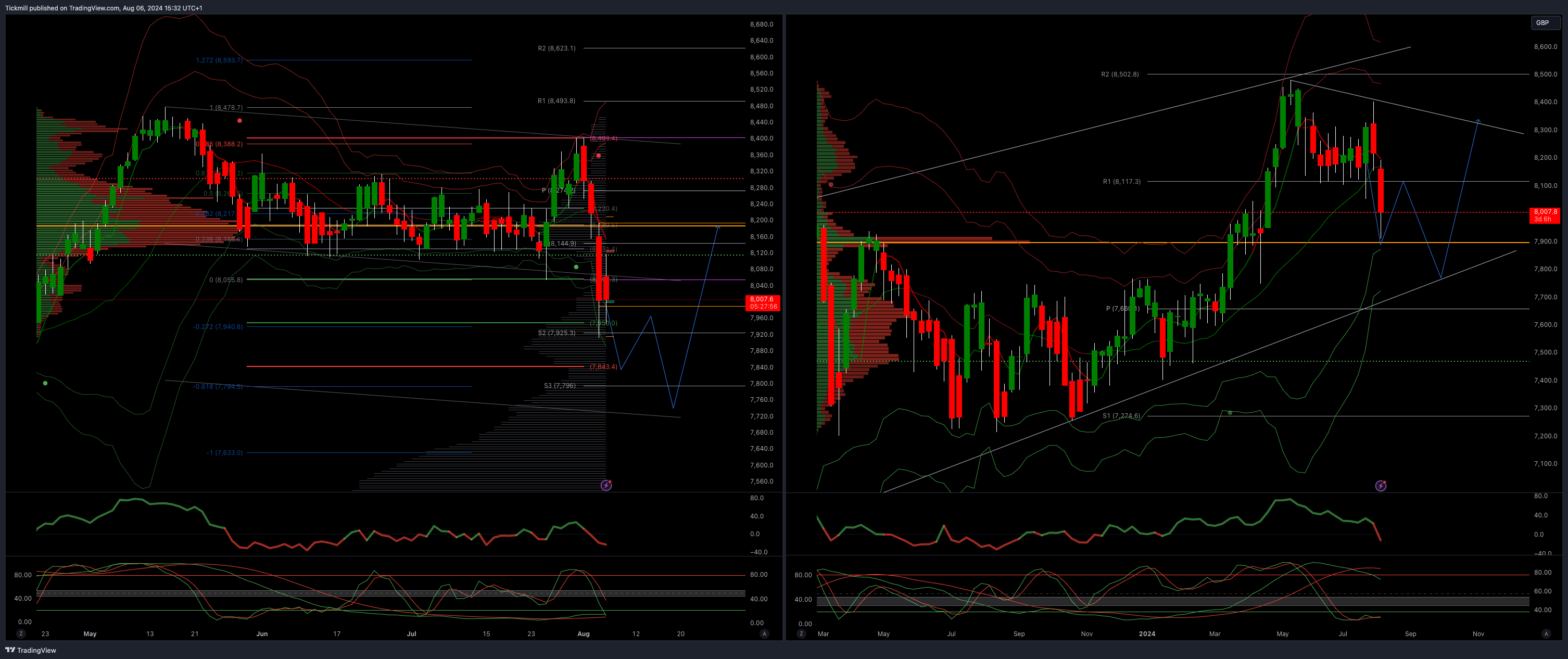

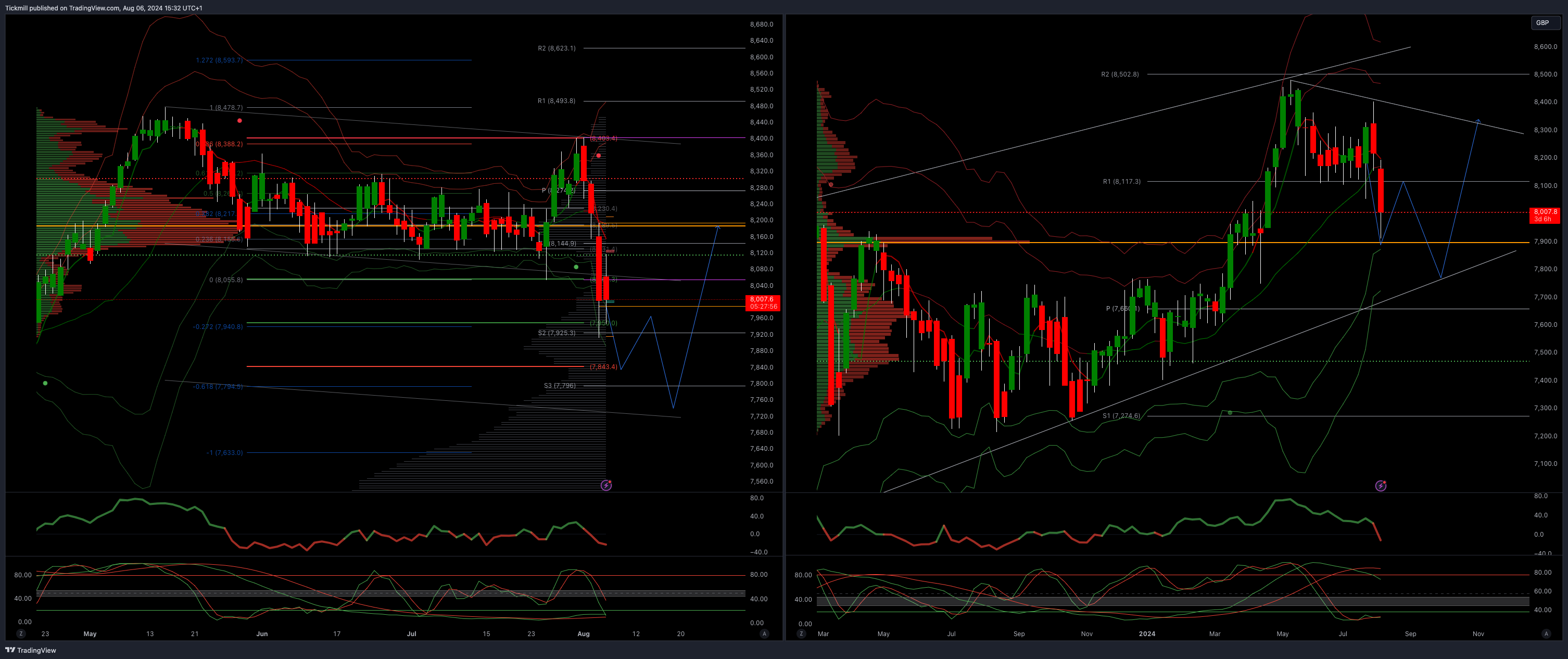

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary resistance 8400

Primary objective 7750

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!