The FTSE Finish Line: April 08 - 2025

The FTSE Finish Line: April 08 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

The primary indexes in Britain bounced back from their lowest points in over a year on Tuesday, as investors seek clues about a potential easing of Washington's tough stance on the aggressive tariffs that have unsettled global markets recently. The FTSE 100, a benchmark for blue-chip stocks, increased by 1.8%. Markets were unsettled following the announcement by U.S. President Donald Trump of extensive trade tariffs last week, igniting concerns about a potential global recession. Trump stated on Monday that he would engage with China, Japan, and other nations regarding the tariffs but was not considering a halt on the duties. Meanwhile, data from the funds network Calastone indicated that British investors had significantly invested in U.S. stocks in the weeks leading up to Trump's tariff announcement. Throughout the day, 94 of the FTSE 100 stocks saw gains.

Single Stock Stories & Broker Updates:

Impax Asset Management Group drops 20%, the lowest since Sept 2017, as it forecasts FY profit below market estimates due to a 26% fall in managed assets and the impact of the trade war. CEO Ian Simm notes uncertain market conditions for FY25's second half. Net inflows affected by St. James's Place terminating a 5.1 bln-pound mandate and account closures. IPX down 17.5%, with YTD losses around 50%.

Diageo shares rose 1%. The European Commission proposed 25% counter-tariffs on U.S. imports, excluding bourbon whisky, in response to U.S. steel and aluminum tariffs. Some tariffs begin May 16, others on December 1. European spirits exports to the U.S. are expected to hit €2.9 billion ($3.18 billion) by 2024. Diageo stock is down 22% year-to-date.

Shares of Gooch & Housego Plc rose 10%, driven by a positive trading update. The company anticipates limited direct impact from U.S. tariffs, which may benefit some areas of its business. Analysts noted organic revenue growth of 7.5% on constant exchange rates. The stock is currently at a session high, reducing year-to-date losses to about 21%.

Shares of Belluscura plummet 50.4% to 0.62p after withdrawing its 2025 forecast due to new U.S. tariffs on China, affecting its oxygen concentrators and parts. 8.7 million shares traded, significantly above the 30-day average of 1.9 million, pushing the stock's YTD decline to 93%.

Shares of PureTech Health dropped 13.7% to 119.2p after Nordic Capital XI announced it would not pursue an offer following a rejected proposal. PRTC has declined about 8% this year.

Technical & Trade View

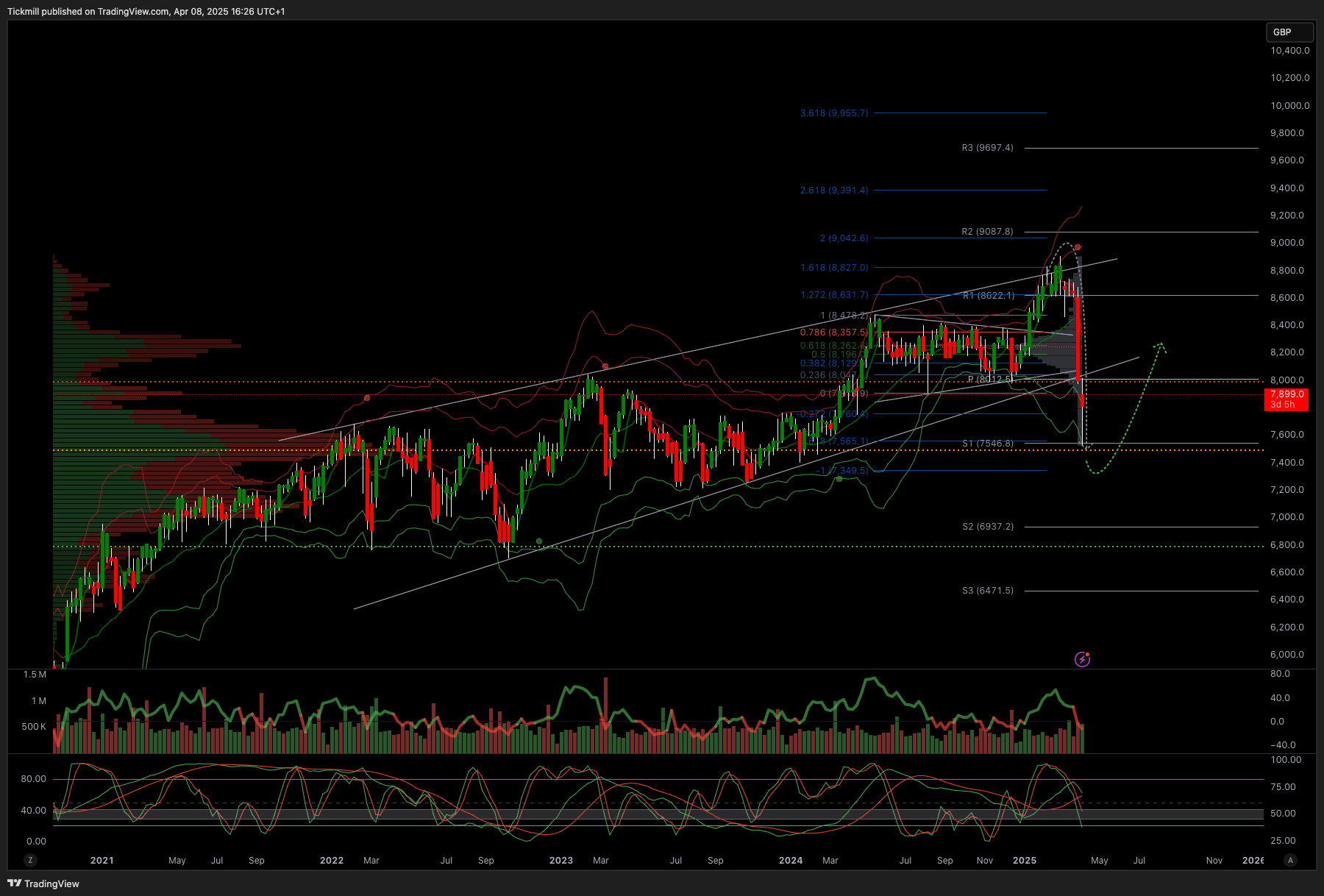

FTSE Bias: Bullish Above Bearish below 8950

Primary support 8700

Below 8700 opens 8600

Primary objective 9050

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!