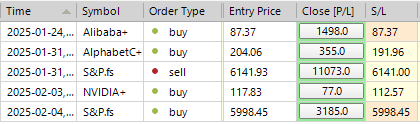

SP500 LDN TRADING UPDATE 5/02/25

SP500 LDN TRADING UPDATE 5/02/25

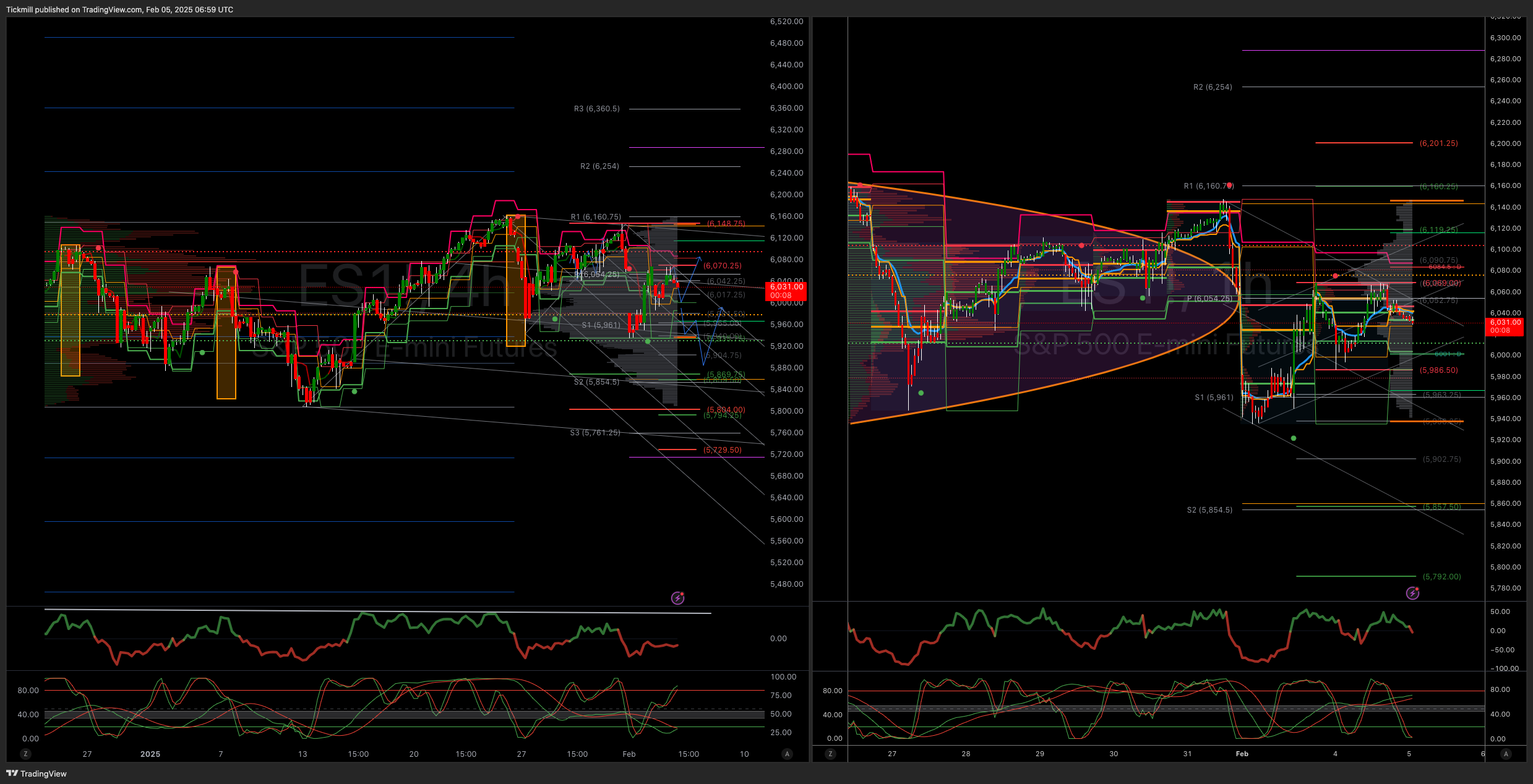

WEEKLY BULL BEAR ZONE 5900/5890

WEEKLY RANGE RES 6086 SUP 5878

DAILY BULL BEAR ZONE 6010/00

DAILY RANGE RES 6087 RANGE SUP 6004

***NOTE WE ARE HEADING INTO A WINDOW FOR POTENTIAL EXTENDED VOLATILITY FROM TOMORROW AS OUTLINED IN THE WEEKLY VIDEO UPDATE BELOW—PERSONALLY, I WILL BE LEANING INTO RANGE/STRUCTURAL RES IN COMING SESSIONS—I HAVE AMENDED MY STOP TO B/E ON THE 6141 SHORT TO ACT AS A CORE SWING POSITION TO TRADE AROUND INTO THE BEGINNING OF MARCH—REMEMBER VOLATILITY DOES NOT IMPLY CRASH CONDITIONS; WE CAN WITNESS LARGE SWINGS WITHIN A PULLBACK—I WILL CONTINUE TO TRADE FROM BOTH LONG AND SHORT SIDE INTRADAY AT MY LEVELS, BUT MY BIAS WILL BE TO LEAN HEAVIER AGAINST RESISTANCE.***

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF WEEKLY/DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES MARKET OVERVIEW: CHOPPY

FICC and Equities | February 4, 2025 | 10:06 PM UTC

S&P +72bps closing at 6037. NDX +126bps at 21566, R2K +141bps at 2290, and Dow +30bps at 44556. A total of 13.35 billion shares exchanged hands across all U.S. equity markets, compared to a year-to-date daily average of 16 billion shares. The VIX fell 822bps to 17.09, Crude decreased 78bps to 72.59, U.S. 10-year yield dropped 4bps to 4.51, gold rose 96bps to 2842, DXY slipped 98bps to 107.93, and bitcoin decreased 387bps to 98125.

Today, stocks generally moved higher, particularly in the energy, discretionary, and tech sectors (PLTR +23% exceeded expectations, SPOT +13% with better-than-expected Q1 guidance, SMCI +7% after announcing its earnings date). GOOGL traded up +2.5% leading into tonight’s earnings announcement, but is now down 5% after hours due to a mixed quarterly report, showing better ad revenue but disappointing cloud revenue (positioning score 8/10). After the bell, SNAP rose 10% with a slight Q4 revenue beat and improved Q1 revenue guidance, while AMD fell 4% (previously +4%) due to missing Datacenter expectations despite posting better guidance mid-point. AVGO increased by 4.5%. Google guided for $75 billion in Capex, surpassing expectations. Tomorrow’s earnings on the desk include UBER pre-market and ARM, CTSH, QCOM post-market.

The overall direction of the NDX has been described as “choppy” over the past two months, with the NDX essentially stalled since early December. It increasingly appears to be a case of “haves” versus “have-nots” in this group, differing from much of the last two years in Big Tech (this may simply be a “snapshot in time” phenomenon). GOOGL, AMZN, and META are currently perceived as ‘loved stocks’, while NVDA is struggling around its 200-day moving average with significant discussions concerning its February 26 earnings print and 2026+ projections. AAPL is hard to find bulls for despite potential catalysts, and MSFT is below its 200-day moving average, nearing a seven-year low relative price-to-earnings multiple – written by Callahan.

Our floor evaluation rated a 5 on a 1-10 scale concerning overall activity levels. We concluded the day +130bps better to buy with over $500 million in net demand. The LOs were net buyers of Tech and Healthcare, with most other sectors trading sideways except for Industrials and Staples. Hedge funds wrapped up with a small selling position, particularly in Macro Products and Communications Services, while showing buying in Tech and Discretionary. ENPH rose by 10% after hours (notable short interest) on exceeding earnings expectations and providing strong forward guidance.

On the macro front, tariffs on Mexico and Canada have been paused for a month, and the 10% tariff on China has been met with only slight retaliation so far – translating to an effective 12% additional tariffs on $14 billion worth of U.S. goods, against 10% on $525 billion in Chinese goods. JOLTS job openings fell more than anticipated (the 10-year yield eased 4bps to 4.51%). Our economists have adjusted the 4Q24 GDP tracking estimate down by 0.1 percentage points to +2.2%. On Friday, we will receive definitive labor market measures with Payrolls data.

DERIVATIVES: A slower day in the options market with both skew and volatility offered as the market grinds higher. Internationally, there was a spot-up/vol-up dynamic with ongoing interest in FXI, EWZ, and VALE. The desk views the EM volatility spread compared to the S&P as tight, especially since equities exposure is possible along with movements in foreign exchange. Despite being light, we anticipate CTAs will act as sellers in every scenario over the next week, while dealers remain slightly long on gamma. The straddle for Friday PM is priced at 1.30%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!