SP500 LDN TRADING UPDATE 31/03/25

SP500 LDN TRADING UPDATE 31/03/25

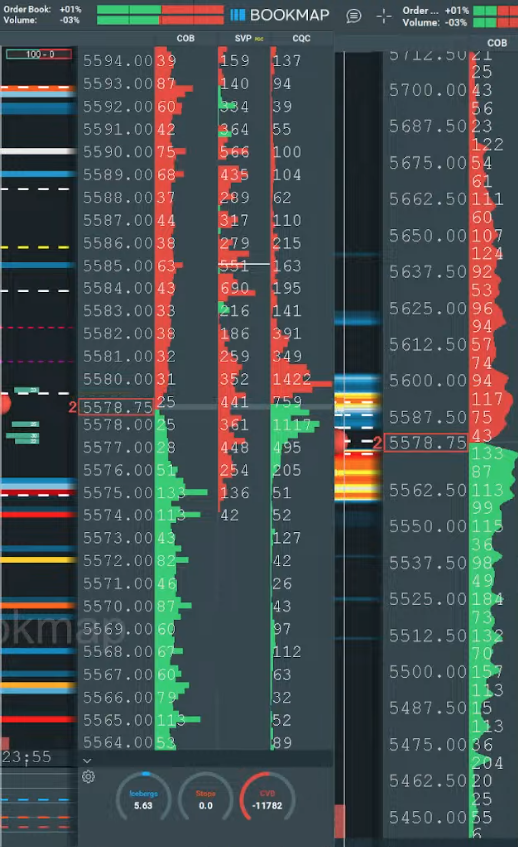

WEEKLY BULL BEAR ZONE 5500/10

WEEKLY RANGE RES 5746 SUP 5458

DAILY RANGE RES 5645 SUP 5560

WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: WEEKLY RECAP

FICC and Equities | 28 March 2025 | 8:21 PM UTC

Market Performance

This week, U.S. equities faced notable declines:

- S&P 500 (SPX): -1.5%

- Nasdaq 100 (NDX): -2.4%

- Russell 2000 (RTY): -1.9%

Investor sentiment remained subdued, weighed down by limited macroeconomic clarity and a series of discouraging updates. Despite the size of the moves, de-risking was primarily executed through macro products or sector rotations.

Flows Overview

- Long-Only (LO) Funds: Net selling of -$3.5 billion.

- Hedge Funds (HFs): Net selling of -$1.5 billion.

- Asset Managers: Continued selling, albeit at a slower pace, with activity shifting to defensive sectors such as telecoms and pharmaceuticals.

- Hedge Funds: Two-way trading persisted, with short books toggling.

The U.S. Fundamental Long/Short (L/S) “Net Leverage” ratio declined by -6.4 percentage points month-to-date in March, on track for the largest monthly drop since records began in January 2016.

Sector Trends

- Largest Sell Skews: Technology and Communication Services.

- Largest Buy Skews: Consumer Discretionary (primarily short covering).

Looking Ahead

As we approach the month and quarter-end, there’s some optimism: April historically tends to be a favorable month for equities. Key events to watch include:

- Sunday, 30 March: China’s NBS PMIs.

- Tuesday, 1 April: U.S. Manufacturing ISM and our custom baskets/derivatives team’s discussion on potential tariff impacts (8:00 AM EST).

- Wednesday, 2 April: Trump’s reciprocal tariff announcement and Tesla’s Q1 delivery numbers.

- Thursday, 3 April: U.S. Services ISM.

- Friday, 4 April: U.S. Jobs Report.

SPX implied move through 4 April stands at 2.6%, with Wednesday’s implied move at 1.45%.

Prime Brokerage Insights

Hedge funds net bought U.S. equities for the first time in seven weeks, though the magnitude was modest (+0.3 standard deviations over the 1-year average). Key drivers included de-grossing activity, with short covering outpacing long sales at a 1.7-to-1 ratio.

- Macro Products (Index and ETFs): Net buying (+1.1 standard deviations over the 1-year average), driven by risk unwinds with short covers outpacing long sales (~3-to-1).

- Sector Highlights:

- Information Technology: The most net sold U.S. sector this week, marking the largest net selling in six months (-1.9 standard deviations over the 1-year average, 99th percentile over five years). Selling was driven by both long and short positions (1.8-to-1 ratio).

- Financials: The most net bought U.S. sector for the second consecutive week (+0.8 standard deviations), buoyed by risk-on flows with long buys outpacing short sales (2.4-to-1 ratio).

Sector-Specific Observations

- Financials: Despite low expectations, incremental capital markets data disappointed. SF reported flat Year-over-Year performance (-20% below consensus), while JEF missed estimates by double digits, including in trading, where a beat was anticipated. Investors remain cautiously optimistic about trading overall.

- Homebuilders: Commented on a slower-than-expected start to the spring selling season. Stay tuned for further updates as we monitor key developments and sector dynamics heading into April.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!