SP500 LDN TRADING UPDATE 16/04/25

SP500 LDN TRADING UPDATE 16/04/25

WEEKLY & DAILY LEVELS

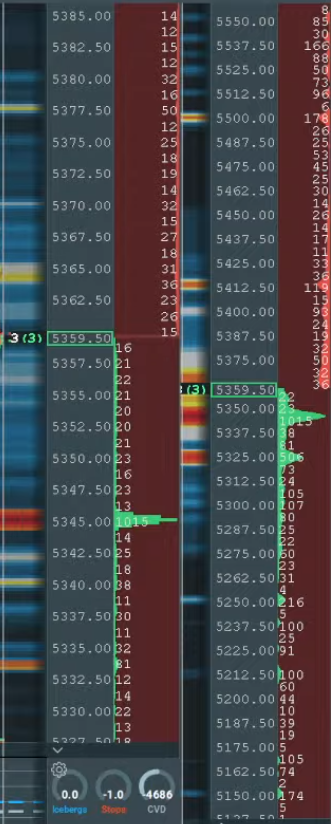

WEEKLY BULL BEAR ZONE 5300/5290

WEEKLY RANGE RES 5640 SUP 5140

DAILY BULL BEAR ZONE 5415/25

DAILY RANGE RES 5485 SUP 5366

2 SIGMA RES 5751 SUP 5099

5425 - 5610 GAP LEVELS

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – 30 POINTS)

WEEKLY ACTION AREA VIDEO https://www.youtube.com/watch?v=mVH_FNAGEFM&t=17s

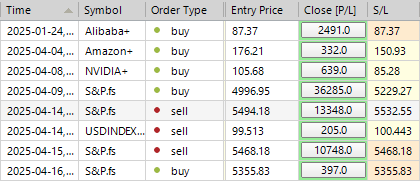

TRADES & TARGETS

LONG ON TEST/REJECT WEEKLY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: UNCHANGED

FICC and Equities | April 15, 2025 | 8:34 PM UTC

- S&P 500: Down 17 bps, closing at 5,396 with a MOC of $3.7 billion to buy.

- Nasdaq (NDX): Up 18 bps, closing at 18,830.

- Russell 2000 (R2K): Up 16 bps, closing at 1,894.

- Dow Jones: Down 38 bps, closing at 40,368.

Trading volume reached 14.4 billion shares across all U.S. equity exchanges, compared to the year-to-date daily average of 16.4 billion shares. The VIX decreased by 2.5% to 30.12. Crude oil dropped 2 bps to $61.52, the U.S. 10-year Treasury yield fell 4 bps to 4.32%, gold rose 69 bps to $3,248, the DXY increased 52 bps to 100.163, and Bitcoin fell 95 bps to $84,038.

Despite a favorable backdrop with lower yields, a stronger USD, and reduced volatility (VIX now below 30), stocks remained largely unchanged. Trading activity was lighter as market participants seemed fatigued by recent volatile price actions, with many adopting a "wait-and-see" approach.

Bank earnings are performing "better than feared," as evidenced by results from BAC, PNC, and C, with worst-case scenarios at the low end of FY ranges. Notably, there have been no major credit blowups, and NII guidance remains resilient with 3-4 cuts priced in. Earnings concerns persist in several areas:

1. Prologis (PLD): Earnings are due tomorrow with negative sentiment due to perceived tariff uncertainty affecting industrial leasing demand.

2. American Express (AXP) & Card Networks: Some positive spending data, especially from AXP considering DAL's commentary, but JPM's deceleration is negative for Visa. The market is expecting a year-over-year top-line growth figure with a 6% handle for AXP, compared to an 8-10% FY guide.

3. Insurance Sector: Speculation that macro/defensive investors in insurance (P&C, brokers) may have set expectations too high, looking for short opportunities.

Activity levels on our floor were rated a 4 on a 1-10 scale. Our floor improved by 511 bps for sale compared to a 30-day average of -705 bps. Total market volumes were down 29% versus the 20-day moving average. Desk skews were neutral. Long-only positions finished balanced, while hedge funds were slight net sellers. Flow dynamics remained consistent with Friday and yesterday, albeit at slower paces. Significant hedge fund coverage in macro products was met with long-only supply (scaled and passive). We have not observed long-duration investors stepping in to buy single stocks perceived as good value.

DERIVS: The market remains quiet as it waits for more clarity on tariffs. We've observed renewed interest in megacap tech and semiconductor stocks, with some downside anticipation ahead of earnings reports. Volatility continues to decrease across the curve, with the VIX reaching its lowest levels since April 3rd. This recent volatility movement has been significant. SPX June fixed strike volatility has dropped approximately 3.75 points over the last two trading sessions. Our desk still favors trades that involve net selling skew, such as knock-out puts, put spreads, and collars. There could be notable activity tomorrow with the VIX expiry in focus, and we expect a substantial amount of dealer short crash positions to roll off in the morning. As we approach options expiration (OPEX), we estimate dealers to be roughly flat gamma. The straddle for the remainder of the week is approximately 1.74%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!