SP500 LDN TRADING UPDATE 10/04/25

SP500 LDN TRADING UPDATE 10/04/25

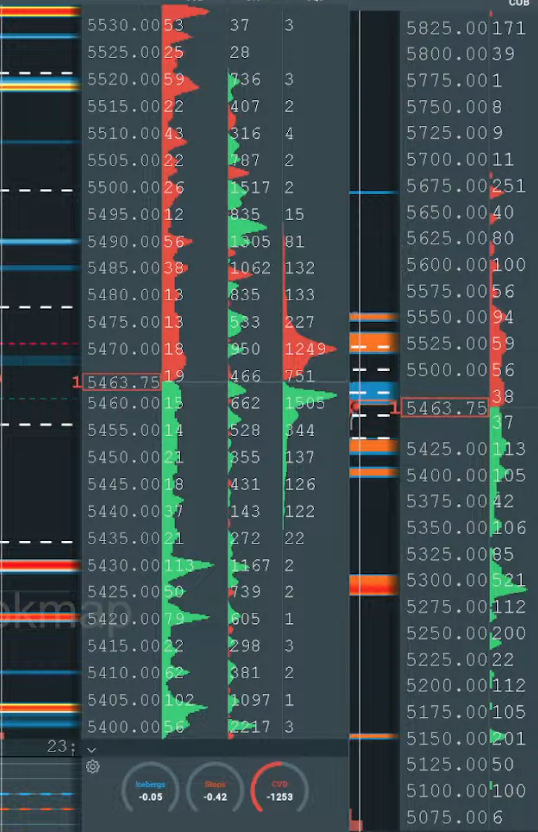

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5050/60

WEEKLY RANGE RES 5443 SUP 4749

DAILY BULL BEAR ZONE 5430/10

DAILY RANGE RES 5563 SUP 5463

2 SIGMA RES 5751 SUP 5251

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – 35 POINTS)

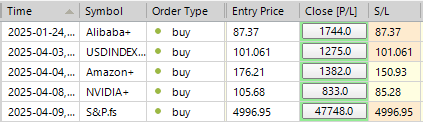

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 5610(GAP FILL)

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: OFF RAMP

FICC and Equities | April 9, 2025 |

Market Performance:

- S&P 500: +9.52%, closing at 5,456 with $3.5B MOC to BUY.

- NASDAQ 100 (NDX): +12%, closing at 19,145.

- Russell 2000 (R2K): +8.5%, closing at 1,924.

- Dow Jones (Dow): +7.8%, closing at 40,608.

Market Activity:

- Record-breaking 30B shares traded across U.S. equity exchanges, significantly above the YTD daily average of 16.3B shares.

- Volatility Index (VIX): -35%, closing at 33.62.

- Crude Oil: +465%, closing at $62.35.

- US 10-Year Yield: +3bps at 4.33%.

- Gold: +298bps, closing at $3,079.

- DXY (Dollar Index): +4bps, closing at 102.99.

- Bitcoin: Unchanged at $83,150.

Summary:

The S&P 500 had its best single-day performance since October 2008, surging +9.52%. The NASDAQ 100 added over $2 trillion in market cap, finishing +12%. Today marked the highest trading volume on record, surpassing Monday’s record of 29B shares.

The rally was fueled by the President’s announcement to pause higher reciprocal tariff rates for 90 days on all countries except China (whose cumulative tariff was increased to 125% effective immediately). The 10% blanket tariff remains in effect for all. This decision provided the "off-ramp" traders were seeking.

Investor Activity:

- Activity on trading floors was intense, rated 9/10.

- Asset Managers ended as net buyers at +$13B, chasing the rally and buying back previously sold positions (AI beneficiaries, semiconductors, megacaps, and cyclicals).

- Hedge Funds (HFs) were net buyers at +$3B, with aggressive short covering (mainly macro products) and long buying in tech.

- ETFs accounted for 37% of today’s total volume (vs 28% YTD average).

- U.S. short flows in macro products were +42% YTD heading into today.

Preliminary performance estimate: Fundamental Long/Short funds were up approximately +2% today, as net exposure was at its lowest level in over five years.

Sector Highlights:

- Delta Airlines (DAL): +23% after Q1 results were in line, Q2 guidance showed no deterioration, and full-year guidance was removed, eliminating an overhang. Optimistic commentary on cost management drove positive sentiment.

- Walmart (WMT): +9.5%, reaffirmed its Q1 sales guidance (one of the few this quarter) and expressed confidence in managing unit quantities, cost of goods, retail pricing, and competitive positioning.

Looking Ahead:

Post-rally, the S&P 500 implies a ~2.30% move through tomorrow’s close. From GS Research, March core CPI is expected to rise +0.27% (vs. +0.3% consensus), corresponding to a YoY rate of +3.03% (vs. +3.0% consensus).

Derivatives Market:

It was a volatile day with moves nearly 3x the implied expectations. The desk favored owning longer-dated volatility due to muted reactions across the curve, a strategy that paid off as clients capitalized on it.

- Front-month volatility saw significant selling, while back-end volatility was heavily bought, outperforming as clients rolled out hedges.

- Topside buying persisted as the market gradually moved lower.

- Following the tariff announcement, front-month volatility was crushed, with SPX May ATM volatility down nearly 7v.

- Skew remained bid during the rally as clients unwound previously owned upside exposure.

Intraday volatility was dramatic, with SPX trading bands reaching levels unseen since the global financial crisis. The straddle for tomorrow is pricing in a 2.30% move.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!