Market Spotlight: BOC Meeting Not as Dovish as Some Expected

BOC Hikes and Keeps Options Open

The Bank of Canada meeting yesterday was a more neutral affair than most were anticipating. The BOC hiked rates by a further .5%. in line with expectations. However, the accompanying language and outlook was not convincingly geared towards a pause. Interestingly, the market reaction to the meeting has seen CAD holding up for now, suggesting that CAD bears didn’t quite get the ammunition they needed.

“Excess Demand”

Looking at the breakdown of the comments, the BOC was seen showing some concern that the domestic labour market remains “tight” and the economy continues to run in “excess demand”. However, the BOC did contend that there is “growing evidence that tighter monetary policy is restraining domestic demand”. On inflation, the BOC noted that consumer prices are still too high though did note that there are some signs of inflation losing momentum.

Rates Outlook

Finally, then, on rates the BOC noted that it is “conspiring whether the policy rate needs to rise further”. Clearly, there is room here for the bank to pause if deemed appropriate at the next meeting. However, there was no firm sign that a pause is coming and as such, CAD trader are left with a more neutral landscape and plenty of two-way risk moving forward. The key now will be how inflation plays out over the coming months as well as the impact China reopening has on the global growth outlook. Falling oil prices suggest that the Canadian economy is likely to weaken a little near-term, cautioning against further rate hikes for now.

Technical Views

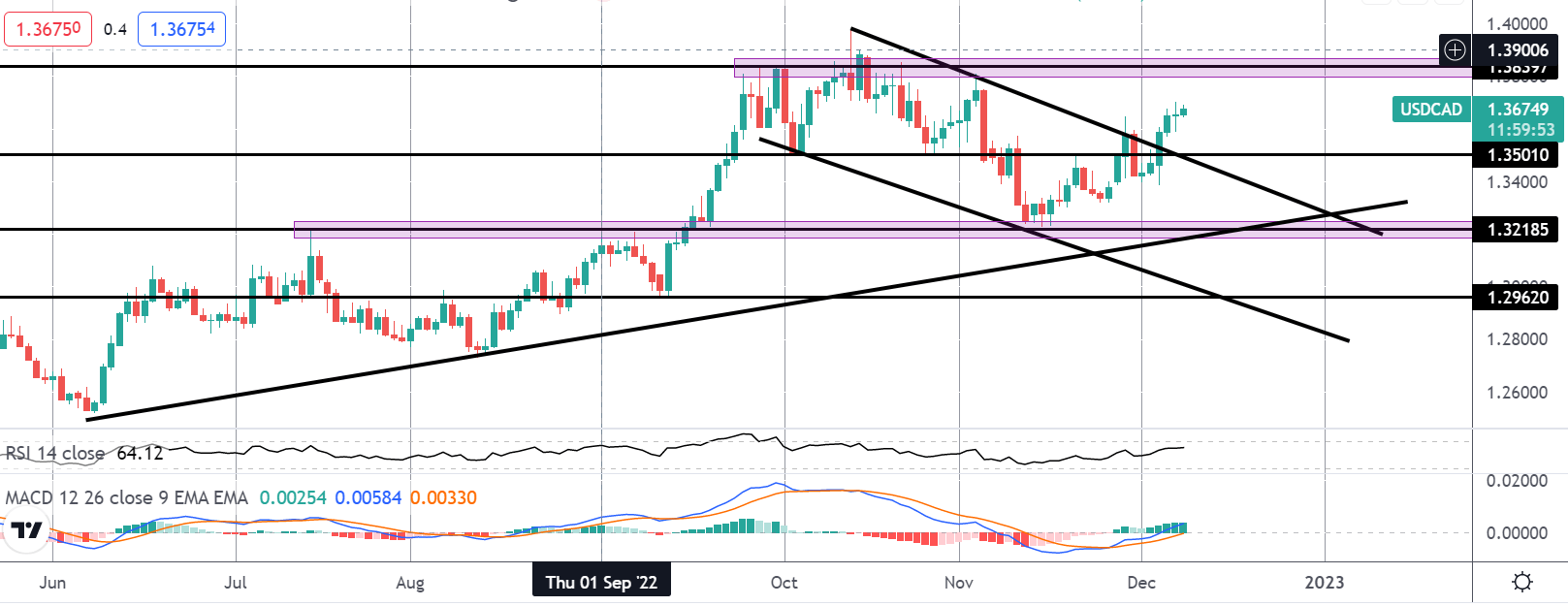

USDCAD

The recent breakout above the corrective bear channel has seen price trading up towards the 1.3839 level resistance. However, price has stalled for now. With momentum studies bullish, the focus remains on a continuation higher and a test of the level while above 1.3501. Below there, price might see a further downside test of the 1.3218 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.