Is 'Uptober' Beginning For Bitcoin?

BTC Rally Continues

Bitcoin prices have continued to rise throughout the week. Despite some trepidation on Monday as to how the market would react to a US government shutdown it seems that BTC has emerged as a preferred vehicle for traders looking to store their capital during this period of uncertainty. While gold is leading the pack in terms of gains, BTC has risen firmly this week with price now eyeing a retest of the current all-time highs should buying continue over coming sessions. A surge in institutional demand, as reflected by soaring ETF inflows, suggests that BCT might soon see a breakout into new highs.

Bullish Q4 Outlook

This view is particularly encouraged by the fact that BTC is now entering what has traditionally been its strongest period of the year. ‘UP-tober’ as it’s become known among crypto aficionados has seen Bitcoin averaging gains of more than 14% since 2013. Indeed, Q4 on the whole has seen BTC averaging gains of more than 80% over the same horizon. As such, the rally we’ve seen over the first 24 hours of October is drawing plenty of attention. Given that BTC looks to be benefiting from the government shutdown and the view that it will ultimately lead to a faster pace of easing from the Fed, BTC looks set to accelerate higher as the shutdown continues.

Technical Views

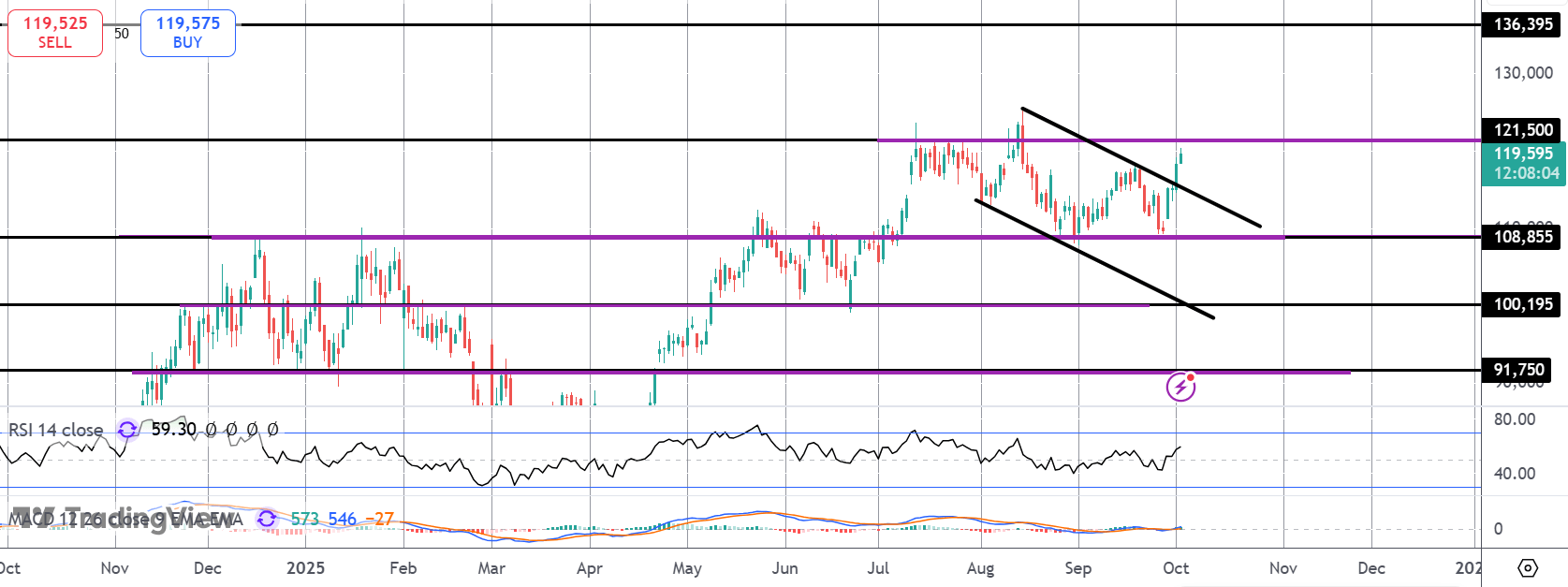

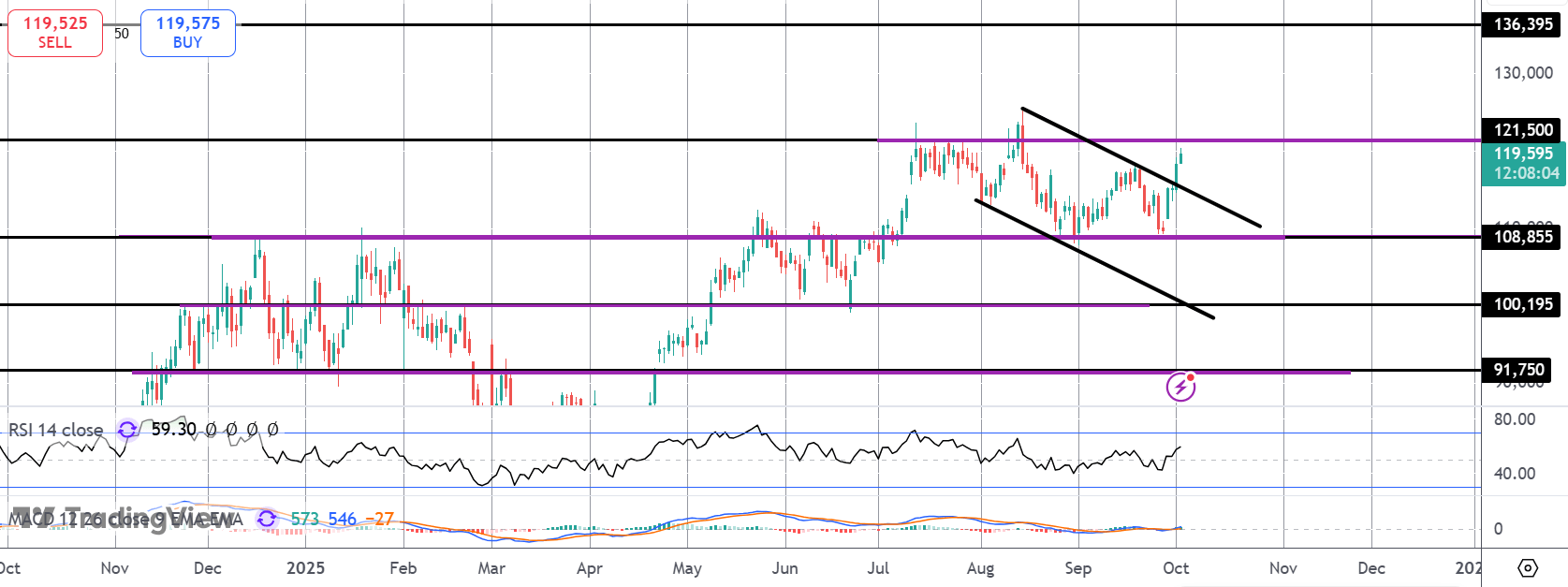

BTC

The rally off the $108,855 level has seen the market breaking out above the corrective bear channel from YTD highs. Price is now close to testing the $121,500 level and those highs. With momentum studies bullish, focus is on a breakout and continuation towards the $136,395 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.