Institutional Insights: UBS - When Should A Short Squeeze Be Faded: Historical Perspective – Buy Protection

.jpeg)

UBS – Market Internal Insight

When Should A Short Squeeze Be Faded: Historical Perspective – Buy Protection

Last Thursday, in the "4/24 Market Internal Weekly: Short Squeeze Mostly Priced-in with Fading Impact to SPX," I anticipated the short squeeze to end soon. Following that, UBXXSHRT experienced a rally of +3.5% on 4/24, but has since tapered off to -0.3% on 4/25 and +0.7% on 4/28.

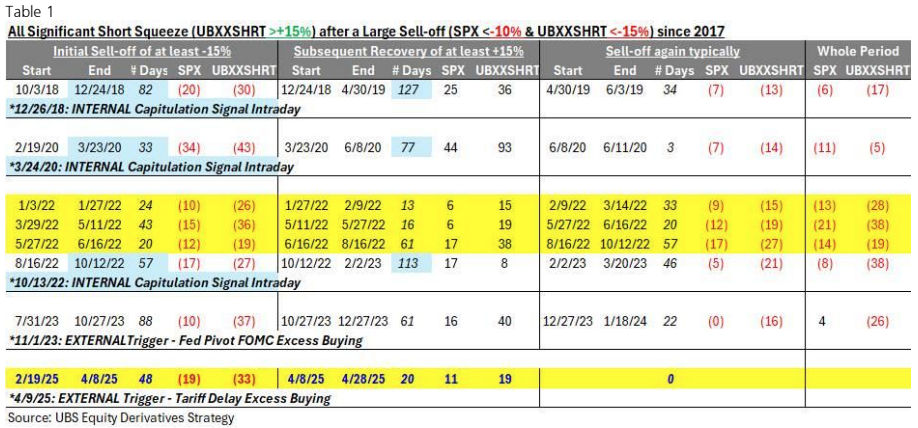

Since 2017, similar significant short squeezes of at least +15% after a market sell-off (SPX <-10% and UBXXSHRT <-15%) have occurred nine other times (Table 1).

- In instances of post-market internal capitulation signals on 12/26/18, 3/24/20, and 10/13/22, the short squeeze lasted for over three months. However, such capitulation signals didn't occur this time.

- Following the 11/1/23 Fed Pivot FOMC Excess Buying, this external shock triggered a short squeeze lasting three months, where UBXXSHRT rose by +40% and SPX by +16%. Although a tariff delay also acted as an external shock that triggered extreme excess buy flow, it didn't have the same long-term supportive Fed implications as November '23. The tariff delay merely postponed the implications without altering the course.

- Excluding the above instances, the current setup resembles January-October 2022 (Chart 2), where negative news in the market led to violent short squeezes whenever relief appeared. In 2022, once the short squeeze ended, the market plunged to new lows (Chart 2) due to persistent negative news from inflation, recession, and war.

- While I cannot predict upcoming news, tariffs are likely to create uncertainty in earnings with a downside bias unless lifted. This suggests the current market is highly fragile and susceptible to external shocks from news, earnings, and policies. SPX is expected to experience significant fluctuations this year. As a reminder, in 2022, SPX faced four sell-offs exceeding -10% and five rallies over +10%, indicating at least a 10% move every 1.5 months.

Therefore, I recommend leveraging the recent short squeeze technical rally (SPX +11%, UBXXSHRT +19%) to purchase downside hedges. VIX is below 25 again, nearing the level before the tariff announcement (4/2 @ 21.5).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!