Institutional Insights: Goldman Sachs 'All that Glitters is Gold (and Silver)

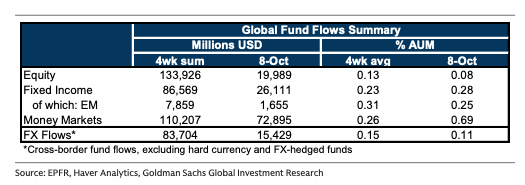

Goldman Sachs structured summary of the global fund flows for the week ending October 8:

---

## Key Highlights

### Equities

- Global equity funds:

Net inflows remained solid but slowed to +$20bn (from +$26bn previous week).

- G10 equity funds:

Stronger net inflows, mainly due to increased demand for US equity funds.

- Japanese equities:

Flows turned negative.

- Emerging Markets (EM) equity funds:

Inflows slowed broadly.

- Sector trends:

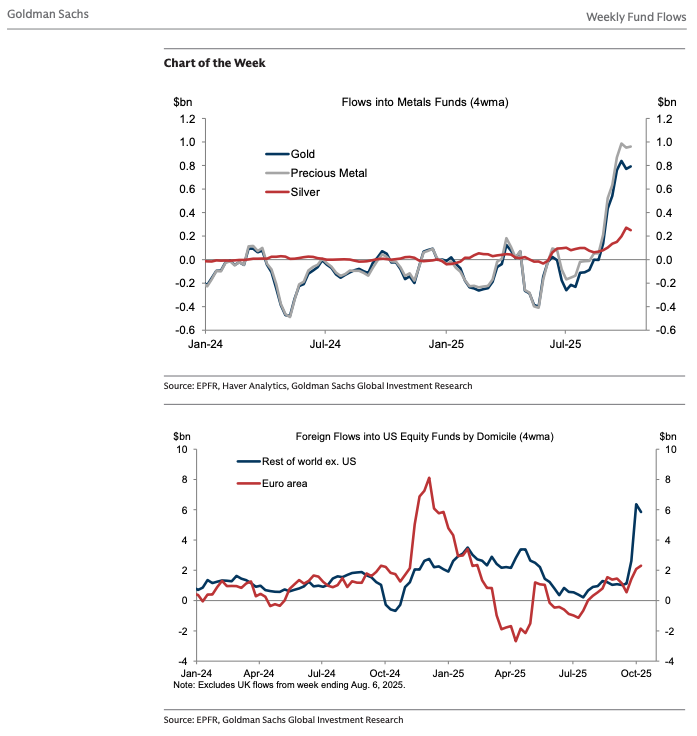

- Industrials & Commodities: Largest net inflows as % of AUM.

- Commodities funds: Averaged nearly 1% of AUM over past 4 weeks, driven by large gold fund inflows.

- Silver funds: Smaller in dollar terms, but inflows averaged about 3% of AUM over past 4 weeks.

### Fixed Income

- Global fixed income funds:

Inflows strengthened: +$26bn (up from +$20bn previous week).

- Agg-type funds: Continued large net inflows.

- EM bond funds:

Local currency bond funds outpaced hard currency bond funds.

- Money market funds:

Assets increased by $73bn.

### FX Flows

- Cross-border FX flows:

Slowed, led by G10 currencies.

- LatAm currencies:

Led by MXN (Mexican Peso), saw the strongest foreign inflows over the past month.

---

## Notable Trends

- Commodities funds (especially gold and silver) have seen exceptionally strong inflows as a % of assets under management (AUM).

- US equities continue to attract robust demand, while Japanese equities have lost momentum.

- Money market funds remain a haven, with significant asset growth.

- LatAm FX stands out as the favored destination for foreign flows in the currency space.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!