Institutional Insights: Deutsche Bank - Investor Flows & Positioning 6/10/25

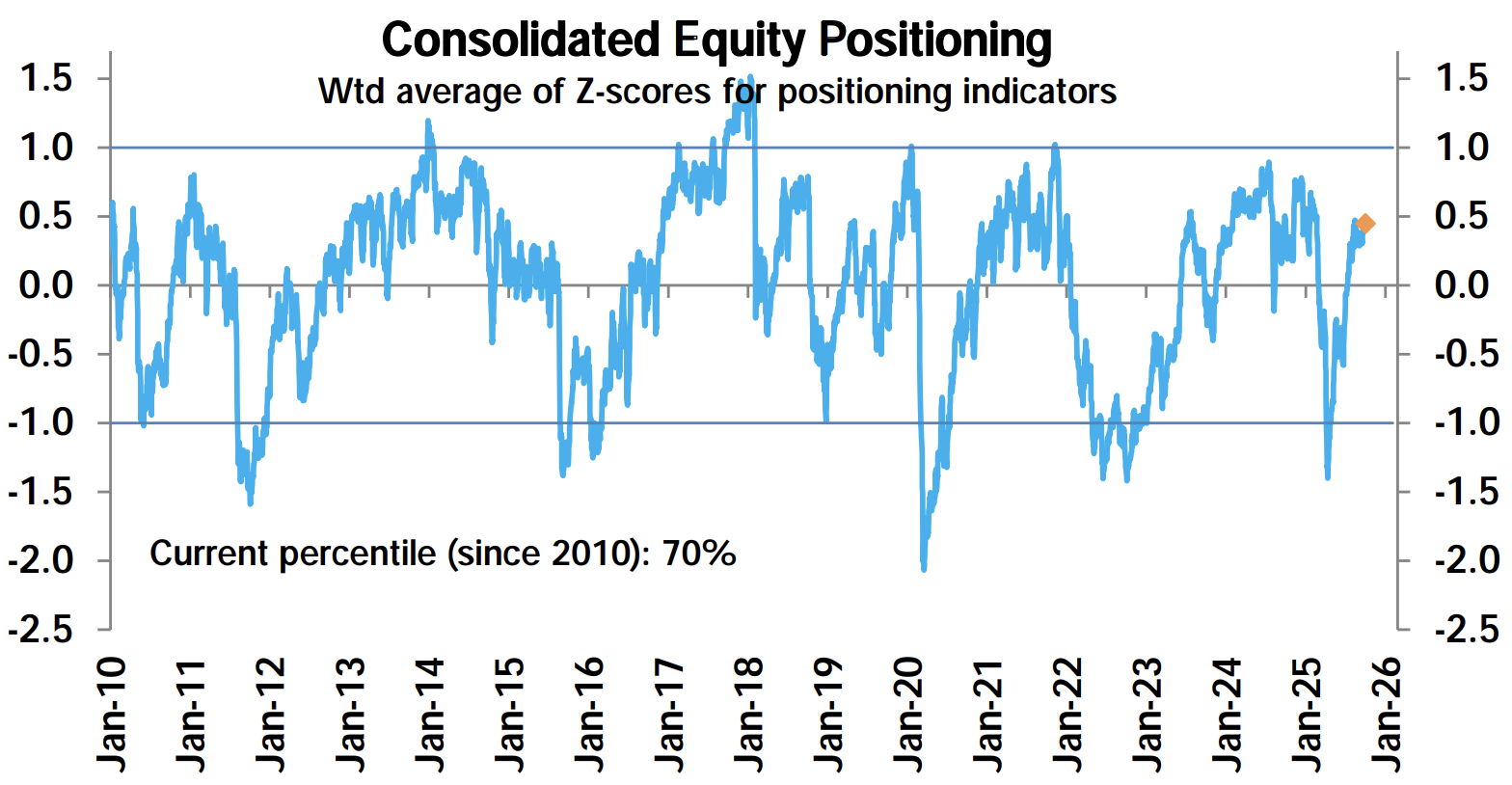

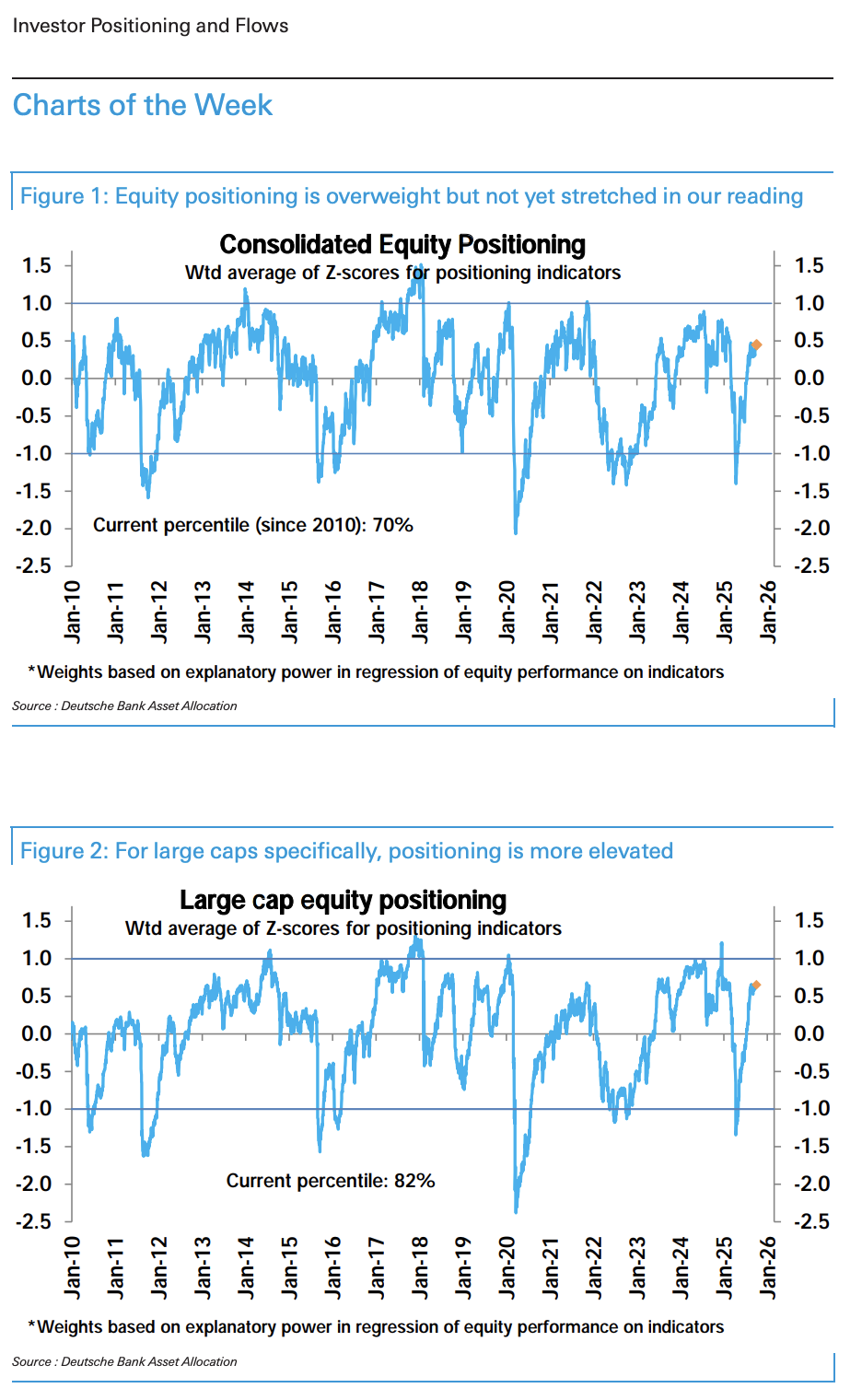

Positioning is still not stretched, yet certain areas warrant attention. As we've indicated for several months, equities have been reaching new highs, but overall positioning is not yet overextended (70th percentile). Conversely, positioning in large-cap equities is comparatively more elevated (82nd percentile), with clear areas of growing momentum chasing.

Significant inflows have been observed. The main narrative for September revolved around not just increasing positioning, but also substantial fund inflows, amounting to $122bn into equities and $98bn into bonds. The total inflow of $220bn in September marked the highest monthly inflow since early 2021, a period characterized by reopening excitement and stimulus checks.

What fuels this influx? As previously discussed, inflows began to surge two years ago when investors shifted away from the anticipated recession. The motivation behind this cross-asset inflow surge stemmed from the considerable cash reserves households accumulated during the pandemic—not from spending this cash, but from their ability to allocate a larger share of new savings into equities and bonds. However, possessing the capability alone is insufficient to generate inflows; fundamental drivers still play a critical role. Inflows fell sharply leading into and shortly after Liberation Day, but rebounded as the administration began to ease restrictions. Initially, bonds saw renewed inflows, but equity inflows are rapidly catching up.

Where are the inflows directed? In equity sectors, Tech inflows remain robust but face competition from other sectors, particularly Industrials and Financials. In fact, in terms of assets under management, inflows to these latter sectors are currently outpacing those to Tech. Geographically, inflows have been strong for both the US and emerging markets (EM). The US inflows have been as expected, while EM has also seen significant inflows since Liberation Day. Over the past year, EM inflows have outperformed relative to assets under management, with China leading in inflows for the last two months. Meanwhile, European inflows, after being strong from February to May, have significantly decreased.

In the bond space, EM inflows have soared post-Liberation Day, along with credit funds that continue to see gains. Government bond funds experienced consistent inflows due to high-interest income, although they saw their largest weekly outflows in three years this week. Investment-grade (IG) and high-yield (HY) bond inflows have been strong, save for a slight setback around March and April. Meanwhile, EM inflows have rapidly increased since Liberation Day.

Here's a summary of the positioning and flows details you provided, organized for clarity:

## Aggregate Equity Positioning

- Overall Positioning: Overweight but not stretched at 0.45 standard deviations (sd), 70th percentile.

- Discretionary Investor Positioning: Near neutral at -0.01 sd, 45th percentile.

- Systematic Strategies Positioning: Elevated at 1.02 sd, 92nd percentile.

## Discretionary Investor Positioning

- Total Net Call Volume:

- Rose modestly this week, elevated at 99th percentile.

- Single Stock Options: Declined from last week's highs.

- ETF and Index Options: Increased to the middle of their respective 2025 ranges.

- Sector Breakdown:

- Defensives and Financials: Net call volume rose.

- Cyclicals, MCG, Tech, and Energy: Net call volume declined.

- S&P 500 Options Skew (3m, 90%-110%): Slightly lower this week.

## Investor Sentiment

- Sentiment Spread: Rose, turning slightly bullish at 43rd percentile.

- Bullish Responses: Increased, now at 71st percentile.

- Bearish Responses: Remained high at 79th percentile.

## Systematic Strategies Positioning

- Vol Control Funds:

- Trimmed equity allocation but remained close to historical highs at 97th percentile.

- CTAs:

- Overall equity long positioning was pared down, still high at 92nd percentile.

- Long Positioning Breakdown:

- US: 89th percentile.

- S&P 500: 89th percentile.

- Nasdaq 100: 93rd percentile.

- Russell 2000: 71st percentile.

- Emerging Markets (EM): 94th percentile.

- Europe: 79th percentile.

- Bonds Positioning: Stayed short at 25th percentile.

- US bonds: Long positioning modestly trimmed (75th percentile).

- Rest of the world: Extremely short (6th percentile).

## FX and Commodities

- FX: Short positioning in the US dollar trimmed (14th percentile).

- Commodities:

- Long positioning in copper: Cut modestly (96th percentile).

- Long positioning in gold: Cut modestly (82nd percentile).

- Oil: Turned short (19th percentile).

## Risk Parity Funds

- Equity Allocation: Stayed flat at elevated levels (88th percentile).

- US Equities: Sideways at (88th percentile).

- Emerging Markets (EM): Rose modestly (89th percentile).

- Other Developed Markets: Rose modestly (80th percentile).

- Bonds: Allocations cut modestly (24th percentile).

- Inflation-Protected Notes: Allocations cut modestly (32nd percentile).

- Commodities: Allocations rose significantly (99th percentile).

This structured overview captures the key points regarding investor positioning and flows, making it easier to digest the information. If you need any further analysis or specific details, feel free to ask!

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!