Institutional insights: Credit Agricole FX Weekly 040/04/25

A USD crisis?

The recent sharp decline in the USD outlook can be attributed to several factors: (1) market concerns that President Donald Trump’s combination of protectionist policies, immigration restrictions, and fiscal austerity could lead to stagflation or even a recession in the US economy; (2) doubts about the USD’s status as a reserve currency, fueled by discussions around the so-called ‘Mar-a-Lago accord’ aimed at rebalancing the US and global economy; and (3) the unwinding of long positions in USD-denominated assets.

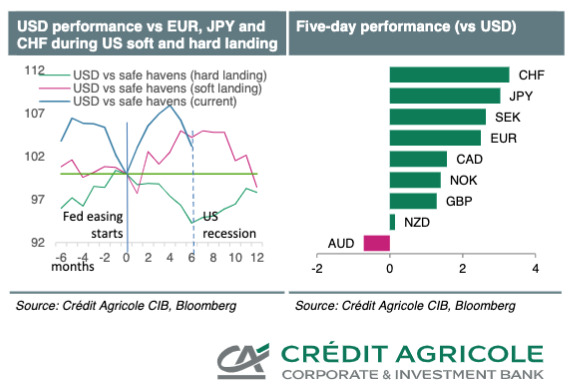

While stagflationary conditions may persist in the US for now, we believe fears of a recession are overstated. Trump’s policies on deregulation and fiscal stimulus are likely to bolster economic activity in the second half of 2025. Historically, however, US recessions and Federal Reserve easing have negatively impacted the USD, particularly against currencies like the CHF, EUR, and JPY, which often serve as hedges during USD downturns. Nonetheless, the USD should remain relatively stable against risk-sensitive currencies.

Concerns about the USD losing its reserve currency status appear exaggerated, given its unmatched role in global trade and the depth of US asset markets. Additionally, a broad-based FX intervention to weaken the USD seems unlikely, considering persistent US inflation, trade tariffs imposed by the Trump administration, and the stagflation risks associated with such a policy.

The most significant risk to the USD in the coming months may be the ongoing reduction of large market positions in US assets, particularly US stocks. We are cautious about the potential for a more pronounced rotation away from US investments, especially among European equity and fixed-income investors.

In the near term, attention will turn to today’s Non-Farm Payrolls report, followed by US CPI data and Federal Reserve commentary next week. Signs that US trade policies are beginning to re-inflate the economy could prompt investors to reconsider their dovish outlook on the Fed and reduce the likelihood of additional tariffs or ‘weak-USD policies.’ Elsewhere, the Reserve Bank of New Zealand (RBNZ) is expected to slow its pace of rate cuts and lower its Official Cash Rate (OCR) by 25 basis points next week. RBNZ commentary on the impact of Trump’s tariffs will be crucial for NZD movements. Additionally, Bank of Japan (BoJ) Governor Kazuo Ueda’s speech next week will be pivotal in shaping market expectations for further BoJ rate hikes and the outlook for the JPY.

FX and Gold Outlook

EUR/USD:

The EUR experienced a sharp rebound in March, buoyed by market optimism around aggressive fiscal stimulus potentially enhancing the Eurozone’s economic outlook, attracting repatriation capital flows, and shortening the ECB easing cycle. While these factors may continue to support the EUR, much of the positive sentiment appears priced in, warranting a more neutral near-term outlook. We anticipate EUR/USD to trend higher over the next 6-12 months, driven by an improving Eurozone economy, particularly if fiscal stimulus boosts confidence across the continent. Additionally, a resolution to the Ukraine war and lifting of sanctions on Russia could deliver a favorable commodity supply shock to the Eurozone.

USD Outlook:

Our below-consensus USD forecast has been effective thus far in 2025, as concerns over the US economic outlook prompted FX investors to unwind the "Trump trade," driving USD lower across the board. Despite the unexpected speed and magnitude of the USD sell-off, we expect USD to remain under pressure over the next 12 months due to the Fed resuming its easing cycle and ending quantitative tightening (QT), alongside fears of fiscal dominance and a potential "Mar-a-Lago Accord." However, a renewed US economic recovery and rising UST yields could provide some relief to USD in H226.

CHF:

The CHF has moved away from its range-trading behavior against the strengthening EUR. EUR/CHF may edge higher through the year as Switzerland’s return to zero interest rate policy (ZIRP) enhances CHF’s appeal as a funding currency. Nonetheless, narrowing inflation differentials should temper CHF’s real valuations, while balanced growth could prevent significant nominal losses.

USD/JPY:

The contraction in US-Japan rate spreads has driven USD/JPY on a volatile downward trajectory. This contraction may have gone too far in the short term, potentially fueling a temporary rebound in the exchange rate. US tariffs have neutralized their impact on USD/JPY by affecting both US and Japanese manufacturers. While unwinding JPY-funded carry trades has weighed on global equities, this trend may have largely run its course.

GBP/USD:

Despite benefiting from recent USD weakness, caution is warranted for GBP/USD in the next 3-6 months due to persistent concerns over the UK’s economic and fiscal outlook, geopolitical risks, and the potential for a US-led trade war. However, GBP/USD could resume its upward momentum in the 6-12 month horizon, supported by sustained USD weakness and signs of improving UK growth. While we are less bearish on EUR/GBP for 2025, given expectations of a resilient Eurozone economy and a less dovish ECB, GBP remains a higher-yielding proxy for EUR and may outperform it in 2026.

CAD:

The CAD remains sensitive to the evolving US administration’s stance on tariffs, with USD/CAD hovering near the 1.44 pivot. Whether tariffs persist long enough to harm the Canadian economy and prompt a BoC response will determine whether USD/CAD settles above or below this level. Canada’s robust retaliation may mitigate risks of significant CAD depreciation.

AUD/USD:

We anticipate a gradual rise in AUD/USD, supported by a shallow RBA rate-cutting cycle, general USD weakness, and improved investor sentiment toward China. US reciprocal tariffs on Australia are expected to have a minor impact relative to other G10 nations, even accounting for Australia’s 10% GST. However, the larger impact of US tariffs via China continues to weigh on AUD’s rally prospects.

NZD/USD:

NZD/USD is likely to grind higher, driven by general USD weakness and potential upside surprises in New Zealand’s economy as it emerges from recession. The NZD stands to benefit from investors reallocating from US assets to Asian assets. Similar to Australia, US reciprocal tariffs on NZ are expected to be minimal, even with its 15% GST. NZ’s lower tariff levels compared to the US further bolster its outlook. AUD/NZD is recommended as a sell during rallies.

NOK:

Norway’s strong fundamentals, higher relative rates, and persistent undervaluation position NOK as a favored long in 2025, assuming global risk appetite remains steady. The Norges Bank’s involvement in FX spot markets could influence NOK’s trajectory, offering additional upside potential.

SEK:

SEK has emerged as the surprising year-to-date outperformer among G10 FX, leveraging its high-beta EUR proxy status. While near-term challenges such as dividend season and Riksbank interventions persist, more definitive evidence of Sweden’s economic recovery is needed for SEK to secure long-term gains.

Gold (XAU):

Gold’s recent aggressive gains may deter buyers in the short term, but its strength is expected to resume later in 2025, supported by central bank purchases and the Fed’s easing cycle, which could lower US real rates and USD. A renewed US economic rebound and rising US rates could challenge gold

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!