Gold Breaks Out As Geopolitical Risks Soar

Gold Jumps on USD Selling

The gold market is on fire today with futures prices breaking out to fresh all-time highs, bolstered by rising geopolitical risks and heavy weakness in USD. The big news today is that the Fed has been subpoenaed by the US government with chairman Powell facing a possible indictment over claims of overrun costs on renovations work last year. The move has been widely criticised as an attack on the Fed’s independence and born out of Trump’s displeasure at Powell’s refusal to cut rates in line with Trump’s own preferences. The news has been met with heavy selling in USD and chatter of a wider “sell-America” trade emerging as fears grow over Fed independence and US creditworthiness. Incoming news flow will be closely watched and gold prices have the potential to run much higher on any Powell indictment headlines.

US/Iran Risks

Away from that issue, traders are also monitoring news flow around Iran with the growing threat of US military action. Trump has vowed to take action against Iran amidst state violence against protestors in recent days and is due to be briefed tomorrow on possible options. If Trump goes down the no-miliary route, such as sanctions, this should help alleviate some near-term risks. However, if it looks as though military action will be sued, gold prices could rally sharply near-term as risk sentiment tanks.

Technical Views

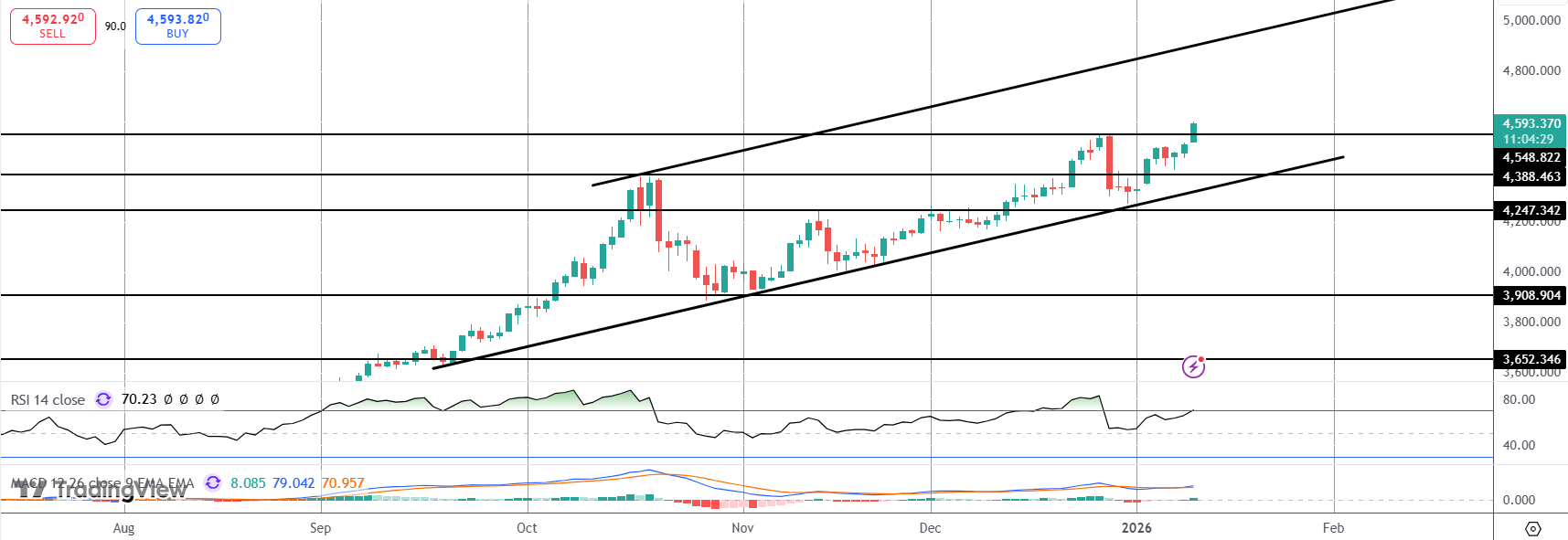

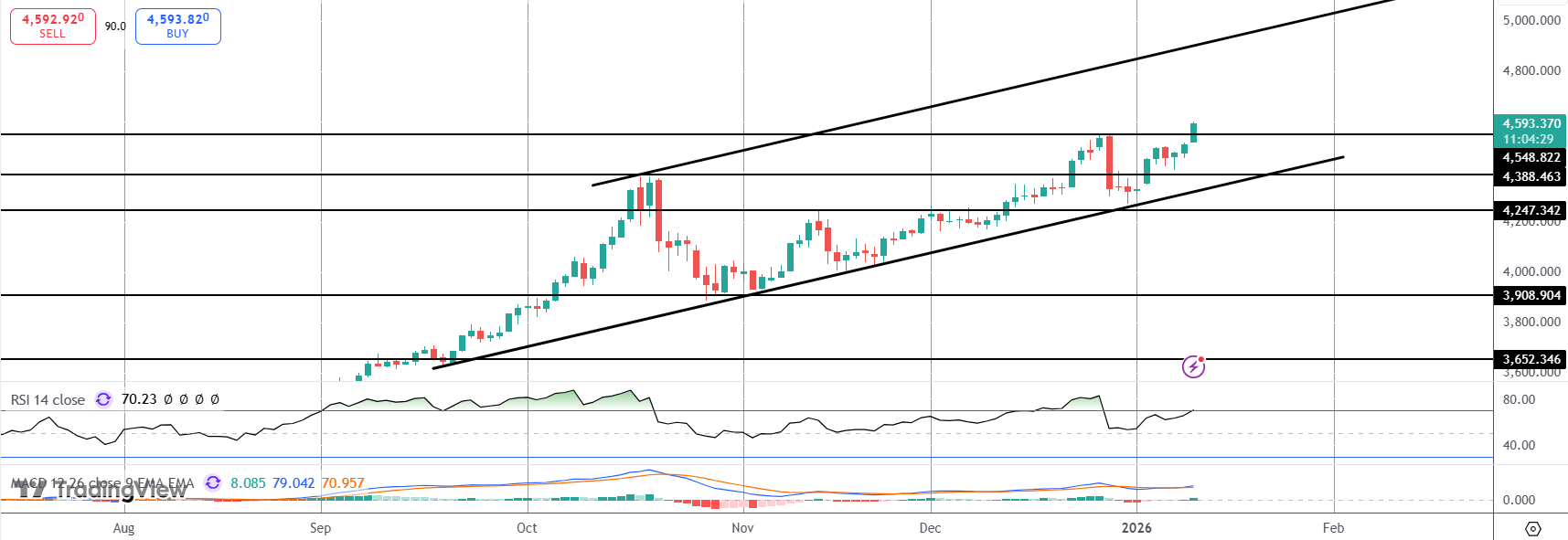

Gold

The breakout in gold above the 2025 highs takes the market into unchartered territory. With momentum studies bullish, focus is on a continuation higher while we hold above that level. In terms of targets, the bull channel highs around the 5000-mark will be the next clear objective for bulls with that target remaining active so long as the bull channel lows hold.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.