FTSE 100 FINISH LINE 21/10/25

FTSE 100 FINISH LINE 21/10/25

London's FTSE 100 initially climbed for a second straight day on Tuesday, driven by gains in warehousing group Segro and banking giant HSBC. HSBC advanced 2% after appointing banking veteran and former NatWest executive David Lindberg as the CEO of its UK operations. The bank's performance contributed to a 1.2% rise in the banking index. Meanwhile, the UK reported record-high borrowing levels for the April to September period, excluding the peak of the coronavirus pandemic. This development intensifies pressure on Finance Minister Rachel Reeves as she prepares to unveil next month’s budget. Adding to economic concerns, the UK is set to release its inflation report on Wednesday, with September's inflation rate expected to hit 4%. This figure would be the highest among major developed nations and double the Bank of England's target. Bank of England Governor Andrew Bailey and his team remain cautious about the inflation outlook, citing uncertainty and making it challenging to predict when interest rates might be reduced; this narrative impeded bullish sentiment, with the benchmark index turning marginally negative into the close.

Finance Minister Rachel Reeves acknowledged that Brexit and previous government spending cuts have had a more significant economic impact than initially anticipated. Speaking to the Guardian, Reeves outlined plans for a budget focused on tax hikes and growth initiatives, aiming to counter an expected downgrade in economic growth forecasts from the Office for Budget Responsibility (OBR). She pointed out that austerity measures, reduced capital investment, and Brexit have weighed heavily on the economy. Reeves stressed the importance of rebuilding relations with the EU to alleviate the costs businesses have faced since 2016. The OBR estimates that Brexit will reduce Britain’s long-term productivity by 4% compared to remaining in the EU. Bank of England Governor Andrew Bailey also highlighted Brexit's continued drag on economic growth. Additionally, data shows public borrowing for the first half of the financial year reached record levels, excluding the pandemic, further increasing pressure on Reeves ahead of the November 26 budget announcement.

Shares of the warehousing company Segro have climbed by 3.4%, reaching 695.6 pence, making it the top performer on the FTSE 100 index. The company attributes this boost to improved occupier sentiment, which led to £22 million ($29.53 million) in new rent agreements during Q3. This brings the total rent signed so far this year to £53 million. Segro also reported its strongest quarter for pre-letting activity since the first quarter of 2024, highlighting significant value opportunities through its expanding data centre pipeline. Despite today’s gains, the stock is still down approximately 0.8% for the year to date.

.

Technical & Trade View

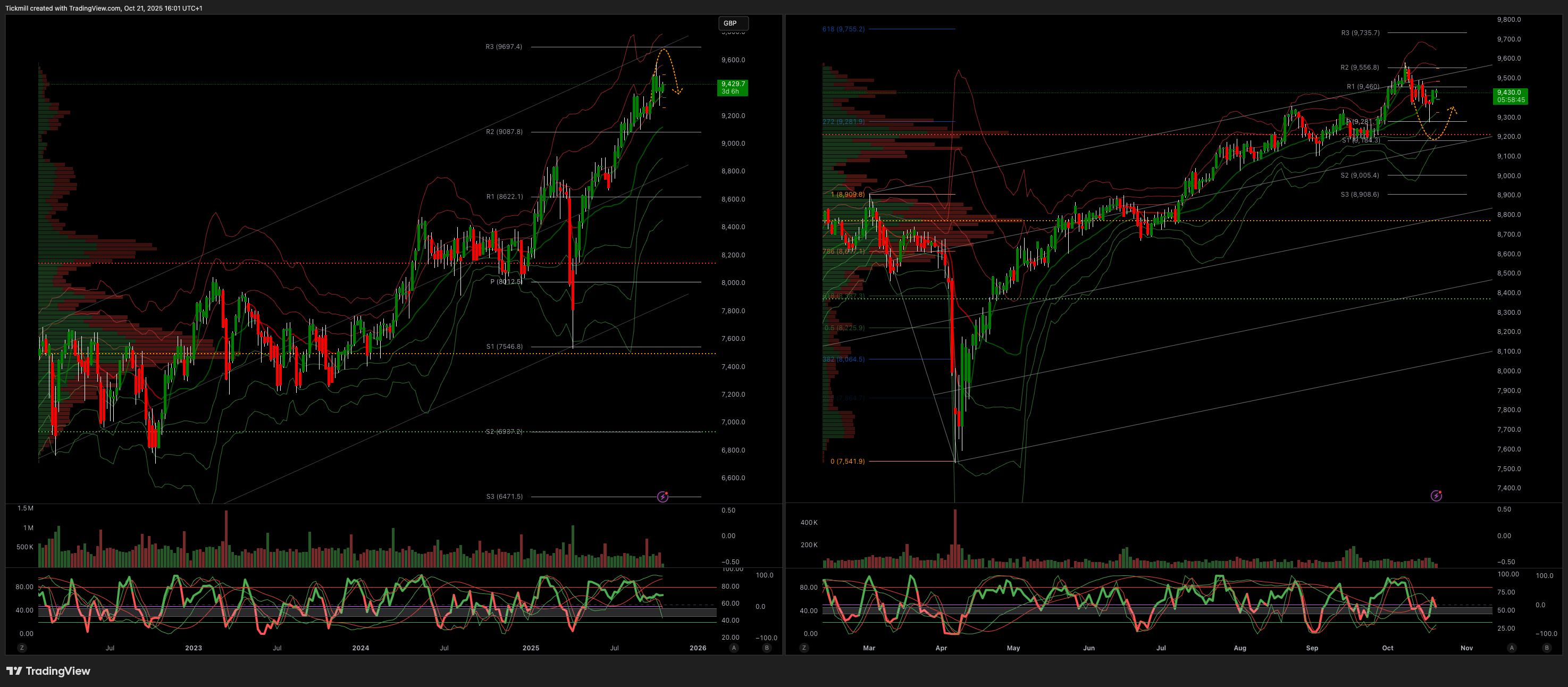

FTSE Bias: Bullish Above Bearish below 9330

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!