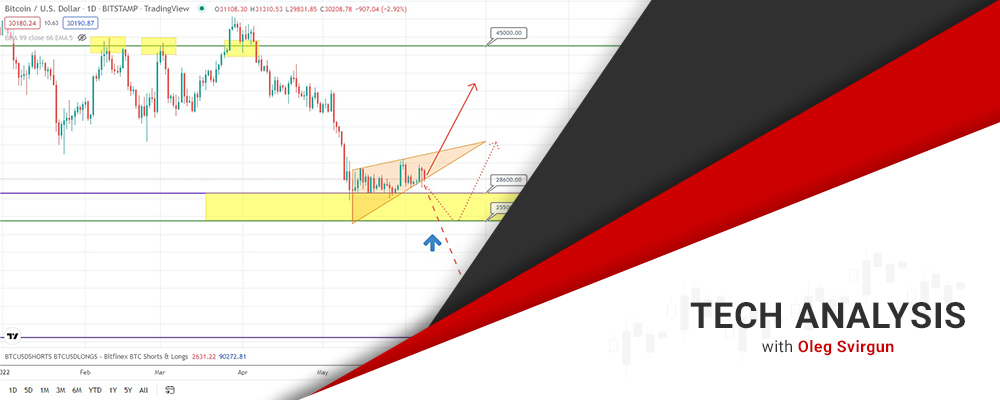

Bitcoin Likely to Drop Soon

Bitcoin keeps moving in a very narrow range, deciding on the next move. The asset is likely to pull back from the resistance area formed between levels 28600 and 25500. Considering the high volatility of this asset, it seems that the price of Bitcoin is likely to dive and target the lowest level of the supporting zone. Both the common traders and large market players are keen on buying Bitcoin. Of course, Bitcoin might also break the supporting zone, but this is less likely to happen. So, it is worth observing what is going to happen next.

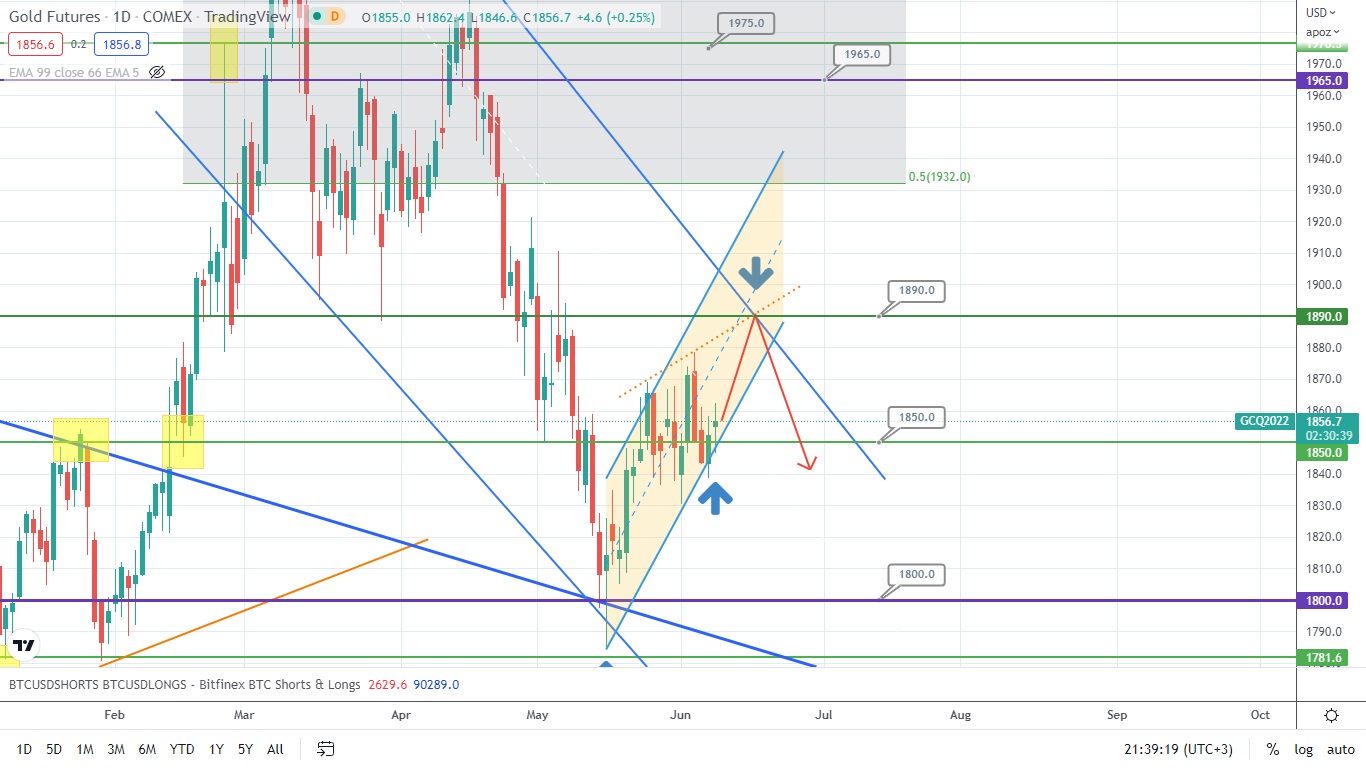

Gold is testing the level of 1850 and ascending line of the local trend, trying to close the trading day with a small candle and signifying the continuation of ascending move. It is noteworthy that the downtrend is at the resistance of 1890. Hence, gold is likely to drop at the crossing point of the abovementioned trendlines.

Brent oil is testing the resistance at the level of 124 and might target the historical level of 138 next. It is likely to break the level of 124.00 through. However, oil might not manage to break a very important level of 138.00 just yet, but undergo correction instead, and drop. In this case, it would be interesting to follow the price movements next to the resistance.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.