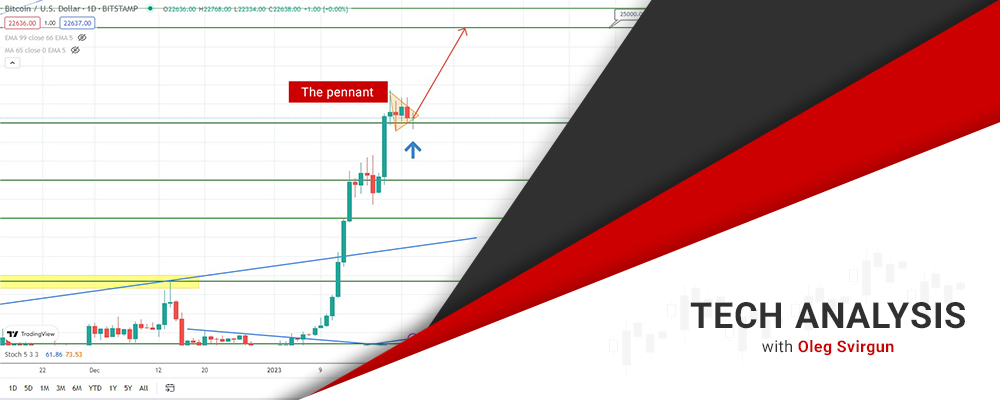

Bitcoin is Heading North

The price of Bitcoin remains at the broken level of 22000, trying to form a small spinning white candle. Given the previous formation of a long white candle, it is safe to assume that the pennant formation is about to happen soon. Bitcoin might potentially have to face resistance at the level of 25000.

Gold has formed an uptrend. The asset is heading up. So far, gold is likely to pull from the lower boundary of the uptrend and jump. Although it would be wise to check the candlestick formations within this uptrend.

Brent oil broke the daily downtrend. Currently, the asset’s price is forming small candles along the broken trendline. Also, the reversal double bottom pattern or the modified version of the failed swing pattern with the neckline at the level of 86.00 can be seen on the chart. Hence, oil is likely to jump soon. So, let’s see whether this scenario might work out.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.